For the SPX Friday 28 June 2024 meets the criteria for a peak (bearish) Key Reversal Day:

‘Key Reversal Day: In a bearish key reversal the market OPENS above the prior close, often leaving a gap, sets a new high, and then closes the day lower than the prior day’s close.’

A two day chart from 27 and 28 June 2024 is shown for the SPX below.

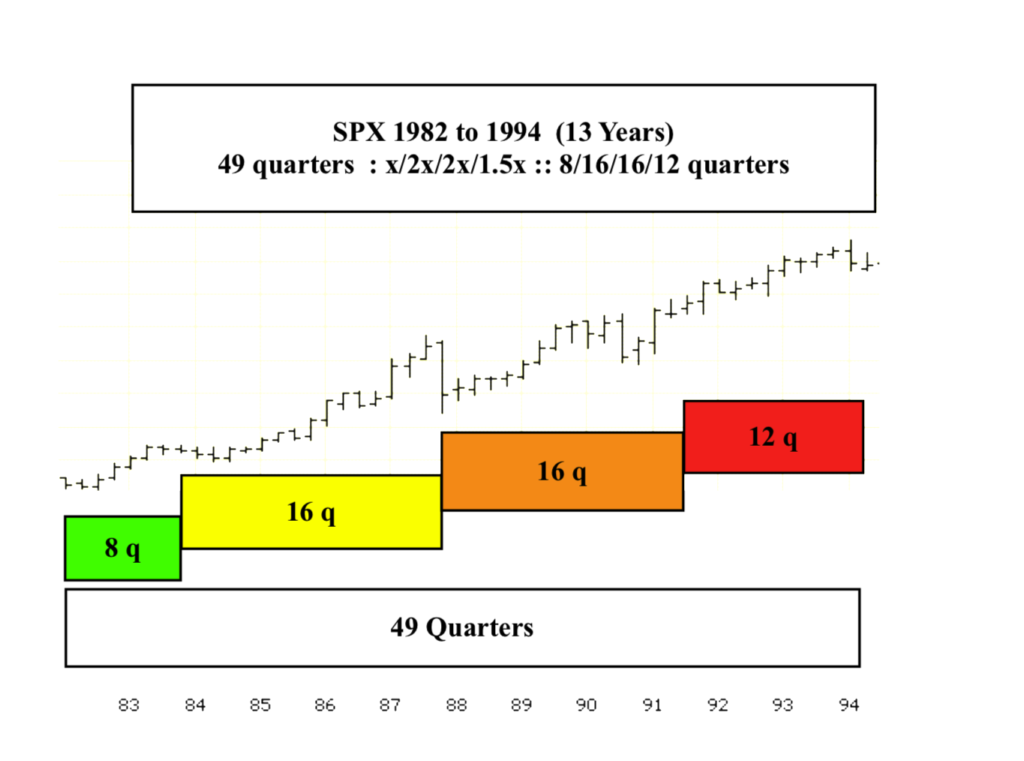

28 June 2024 for the SPX represents year 31 of a 13/31-33 year 1982 first and second fractal series. As an update from the second picture below 28 June represents the 121 quarter of a 49-50/123-125 quarter first and second fractal series

For the SPX 28 June 2024 represents day 114 of a 55/112-140 day 27 October 2023 first and second fractal series. The SPX is in the terminal 2x to 2.5x portion of the 112-140 second fractal window where nonlinear occurs.

US total market cap to GDP ratio was at 193.3 % on 27 June 2024, still more than 6% below its 2021 199.5% peak.

Second Fractal Nonlinearity:

From the 2005 website page of TEF regarding first and second fractals (cycles) of a 4 phase fractal (cycle) (x/2x-2.5x/2x(to 2.5x)/1.5-1.6x series.

…. “The first two cycles include a saturation transitional point and decay process in the terminal portion of the cycles. A sudden nonlinear drop in the last 0.5x time period of the 2.5X is the hallmark of a second cycle (fractal)and characterizes this most recognizable (fractal) cycle.”