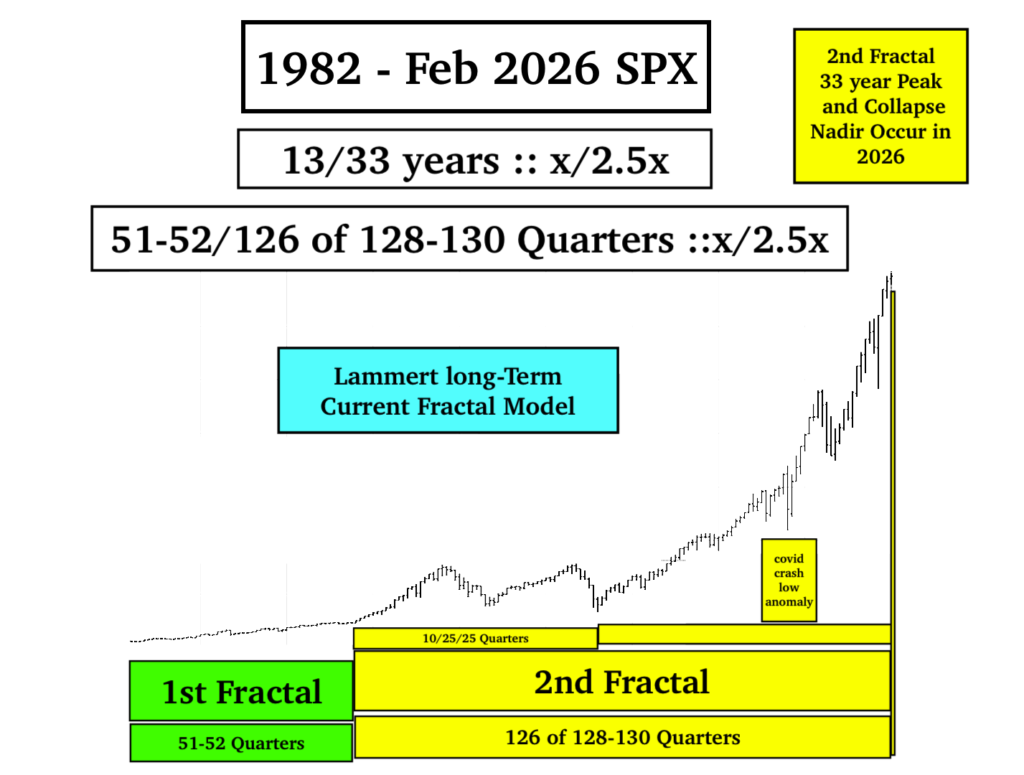

Cryptocurrencies reached a GBTC EFF proxy 41/83 month :: x/2x maximum fractal peak valuation in Oct 2025 under the umbrella of the SPX and global equities 1982 13/33 year :: x/2.5x maximum fractal growth peak. Peak asset class valuations within the macroeconomic asset-debt system have been stretched thru optimal conditions: financial engineering and recent cherry-on-top private debt financing, 25 years of more than 10 trillion dollars of corporate buy-backs, 25 years of outsourcing of Americn manufacturing to foreign labor and foreign countries for lower cost and higher American corporate profit, 2009 QE bail-out money printing to banking and financial institutions, and 15-11% GDP deficit COVID spending in 2020 and 2021, respectively, accompanied by low interest rate mortgage-backed securities and out right money printing to sway the 2020 election with citizens, many who received checks (with the then president’s signature) greater than their real salaries.

The global peak of the system’s composite asset valuations has already occurred.

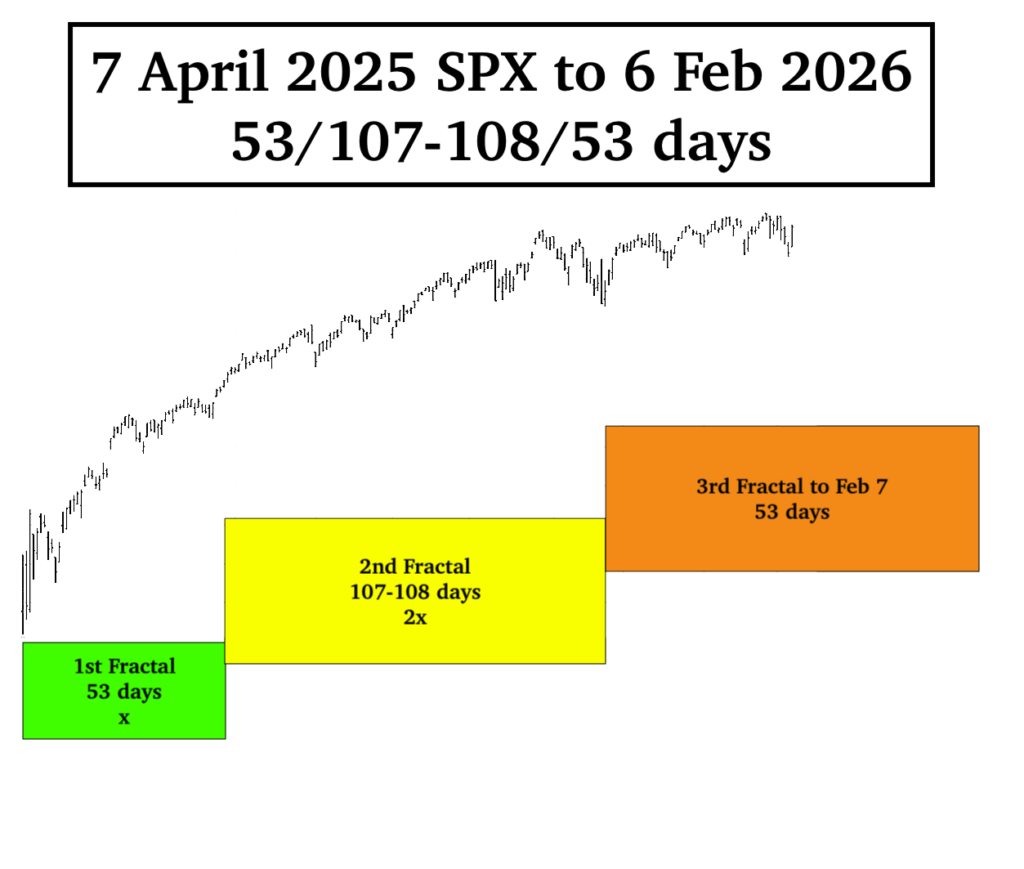

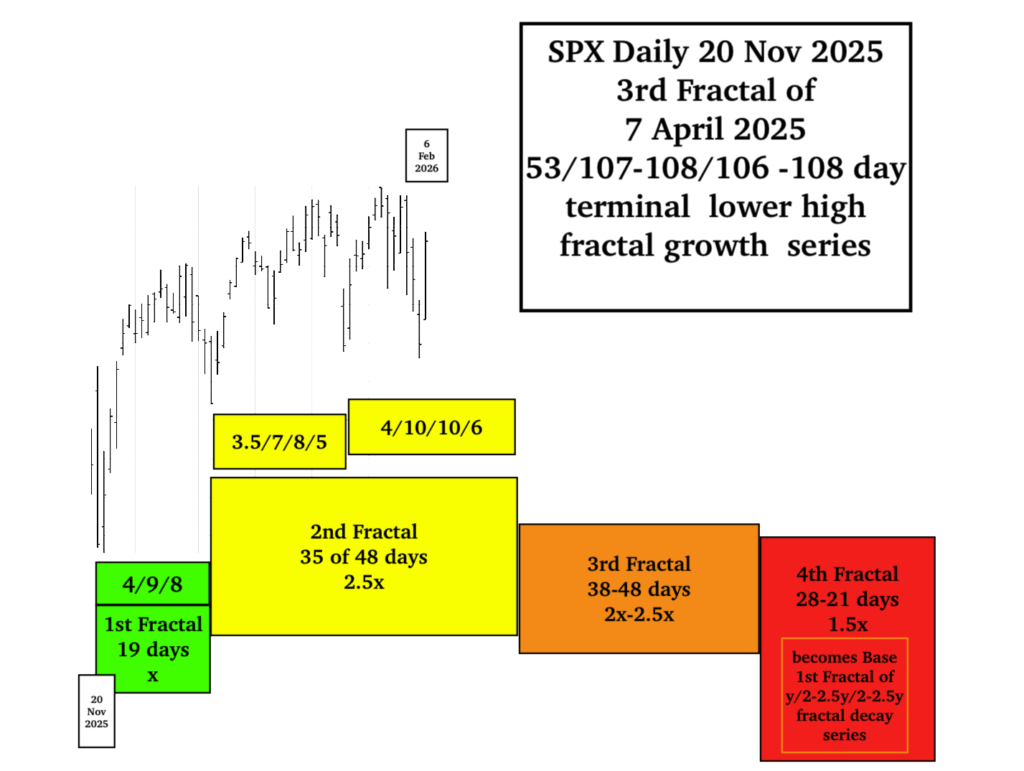

There may be additional 2026 peaks in composite equities and gold and silver from rotational money, but the SPX 13/33 year 1982 cycle will end in a same year, 2026, with a historically dv/dt2 severe collapse of all non sovereign debt asset class valuations.