In the asset-debt macroeconomic system, expansion of credit and a growing money supply – occur primarily via US sovereign or other sovereign directed debt markets. This constant credit expansion is essential for the ongoing liquidity needed to support higher equity valuations. Sovereign debt expansion follows governmental fiscal deficit spending and its expansion.

When the system’s lender participants demand higher sovereign debt interest rates primarily because of the higher risks associated with grossly peak overvaluation of equities, real estate, and commodities and concerns about fiscal responsibility, the asset debt system reaches an inflection point; and non-debt asset valuations nonlinearly devolve to new price levels reflecting the default, liquidation, and/or reordering of non-repayable private debt in the real economy, i.e, corporations and individuals.

With the Nikkei’s and the Wilshire’s close to 210% of GDP valuations, it appears that the global sovereign global debt market is very near that inflection point. Added to the overvaluation of equity relative to GDP is the anti-institutionalism and anti-constitutionalism of the current administration’s American trade and alliance mutable transactional policies and divergence from the traditional domestic rule of law policies.

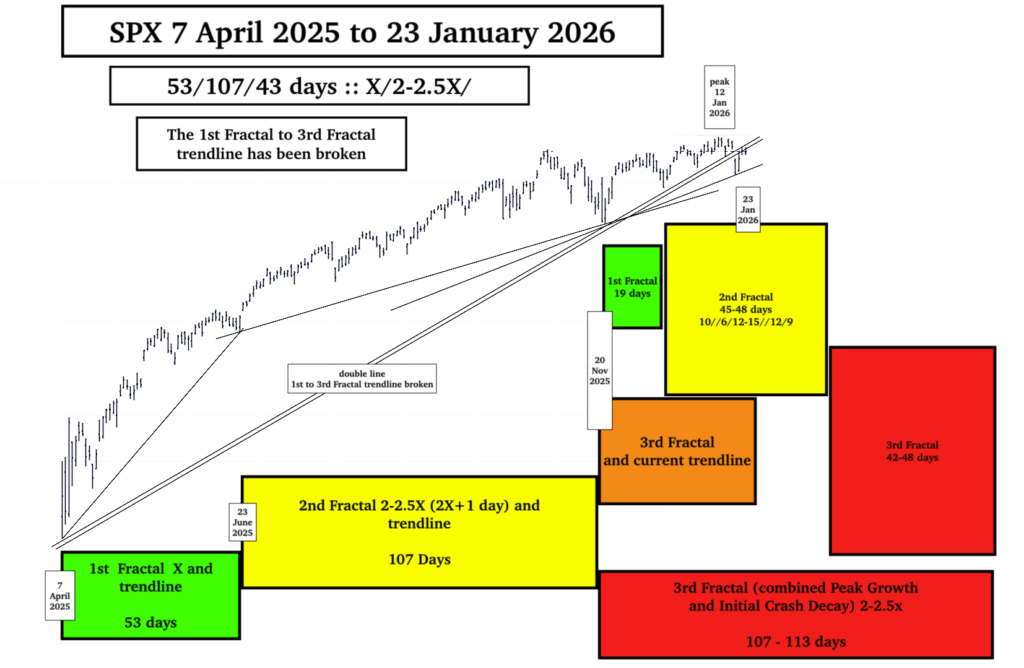

Current 7 April 2025 to 23 Jan 2026 SPX growth and initial crash decay fractal model.