Ford (F) currently pays a dividend of 6 %, has a PE ratio of 6.84%, and represents a basic element for the blue-collar population base of the asset-debt economic pyramid in getting to and from work. The Ford Motor company is essential to the fundamental base asset-debt economy.

Compared to Ford, Musk’s Tesla company provides relatively high priced ‘promoted green’ vehicles for environmentally conscious middle upper class white collar workers. Tesla has no dividend and currently has a PE ratio of 122. Tesla has lost more in market valuation in the last two months than about 20 times the market cap of Ford, which currently sells more than 3 times the number vehicles that Tesla doe …. interesting side by side math and statistics..

Ford represents the workers’ base asset-debt economy; their ongoing stagnant wages relative to inflation, their decreasing job opportunities, the flood of displaced higher paid federal workers, and an increasing pessimism about future work. prospects.

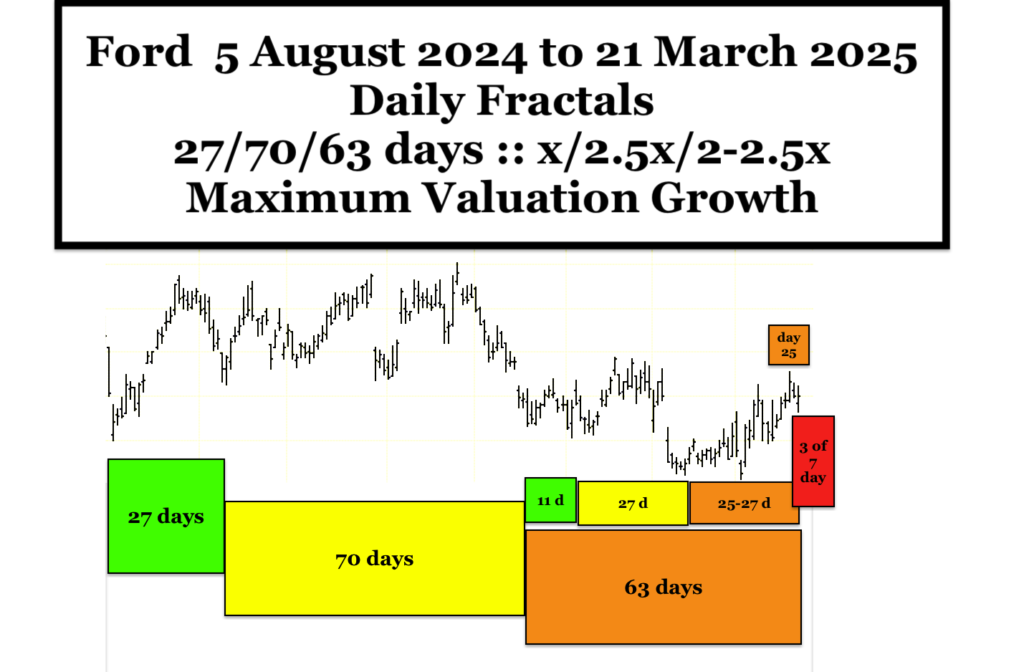

Ford’s ongoing quarterly, monthly, weekly, and daily equity valuation growth and decay fractals integrate and reflect the blue collar workers’ ongoing plight just as Tesla’s stock valuations reflect global consumer collapsing interest and better EV options.

Quarterly. Monthly, Weekly, Daily Ford Fractals

Like the Dow Jones Transportation Index, Ford fractal valuations are falling below the trend lines of 2008 and 2020 nadir-most valuations. A deterministic significant nonlinear collapse is coming completing the 1982 13/32-33 year :: x/2.5x 1st and 2nd fractal series ….