The ordering of the universe is based on provable mathematical laws to the conclusive degree of observational, empirically derived four and five significant figures. The significant figures’ ordering did not occur by chance but by the self-assembly of ‘basic’ energy-mass-vibrational units that are at the core of the universe’s composition. These ‘basic’ units may yet have further dimensions that render these ‘basic’ units composed of yet smaller subunits of mass-energy.

The fibonacci 1.618 ratio is seen everywhere in the observable physical universe. It is proposition of this website that this ratio is also observable in the human affairs environment of non-debt instrument asset maximal fractal growth valuation in the deterministic asset-debt macroeconomic system.

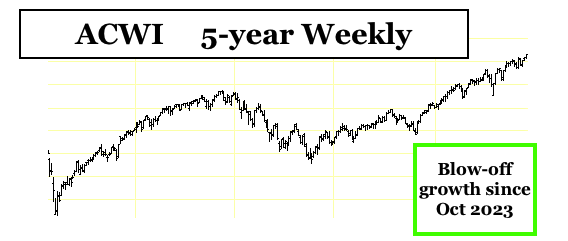

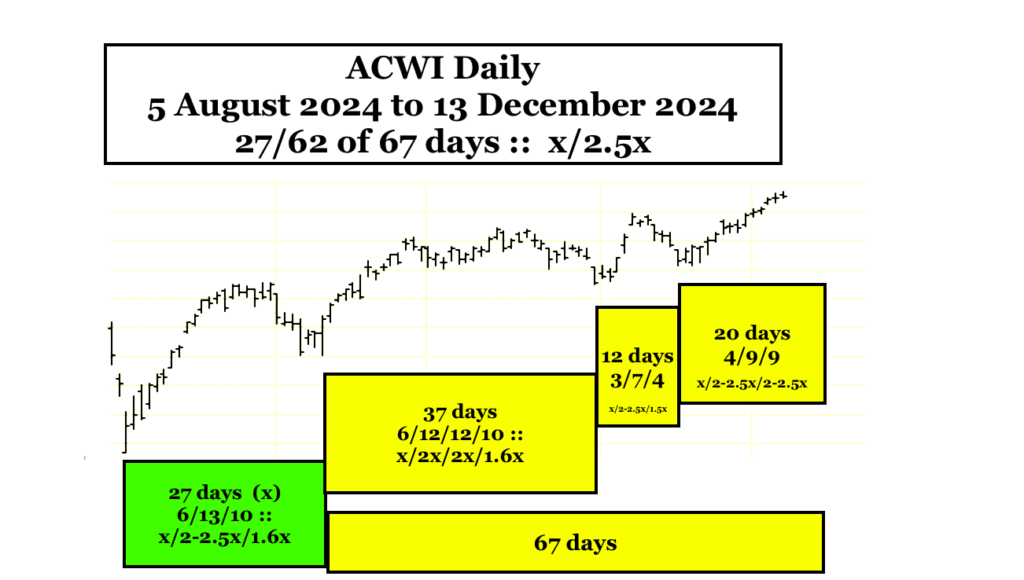

Within the context of the interpolated 1982 to 2025 13/32 year x/2.5x fractal series, the 27 October 2023 ACWI, the World Equity index ETF proxy, is following a 55/139/89 day :: x/2.5x(+) /1.618x maximal growth fractal series with a peak valuation growth of 123.58 on 9 December 2024.

Nonlinear black swans follow peak valuation maximal growth…

Monthly Archives: December 2024

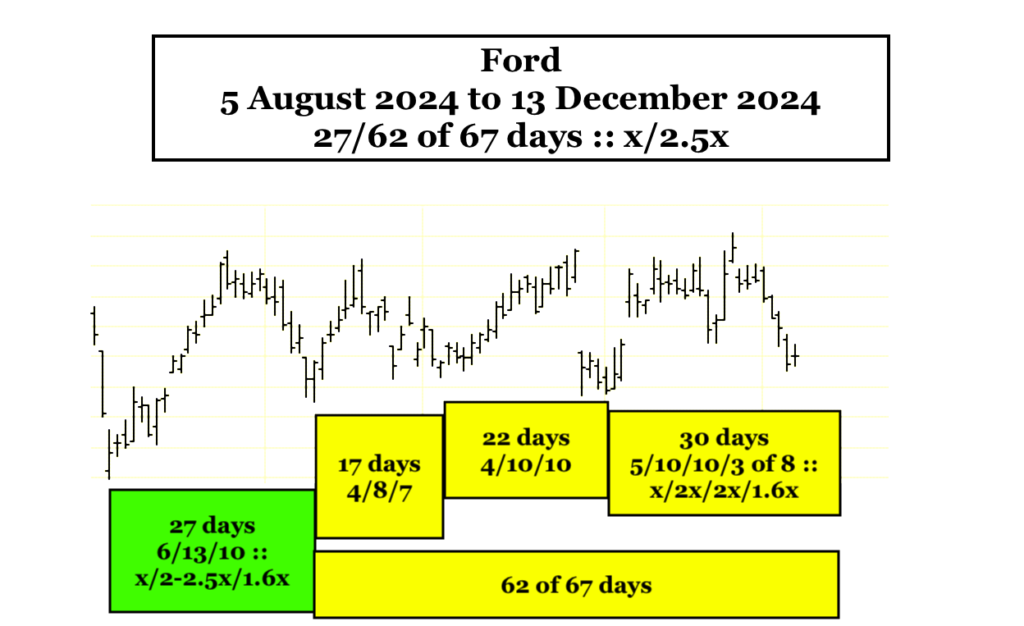

As Ford goes … The 13 December 2024 initial Global equity, crypto, commodity devaluation …

There is a great disconnect between the real consumer based economy and the Wall Street-US Central Bank financialization of US hegemonic governmental debt economy that has produced a 6 December 2024 record 60.46 trillion US Wilshire valuation.

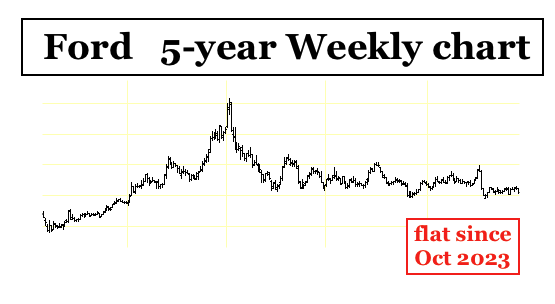

Ford produces vehicles which transport US consumers to work and transport products and consumers to market. Its market cap valuation is 41 billion. Ford ranks only 506th in market cap among world companies. It’s stock valuation and profitability is a proxy for the real ongoing consumer asset-debt based economy.

Ford is under-performing the ACWI, the 100+ trillion dollar-equivalent global equity market proxy, whose valuation is a reflection of the interactive Wall Street-Central Bank (et. al. countries)bubble financialization of governmental debt on the US and global business community.

While the financialization of debt will be the dominant force for the next 30-50 years, a near-term major correction of equity, commodity, and crypto valuations will occur based on the fragility of the underlying real consumer asset-debt economy. During a recession, while Wall Street (via bond creation)and the Central Banks have great potential to create money and debt (and jobs), consumers have concerted limitations. This will be worsened by the 2025 administration’s constraints on the need for increased counter-cyclical governmental spending and its focus on the use of tariffs.