The 14 day valuation gain from the 27 October 2023 low was unexpected but within the 13 March 2023 52 /104 to 130 day :: x/2x-2.5x nonlinear window. Qualitatively, the dominant service sector US economy has an operational consumer population that has no savings and has the highest ever collective debt at the highest interest rates in over 15 years. The consumer is tapped out. The Chinese economy whose base population savings is in real estate has a different, but real problem with the collapse of property and real estate prices and a collapse of stock valuations of the large corporations, e.g., Evergrande and Country Garden who build residential properties and are currently defaulting on interest debt payments. With collapsing Chinese property values (and equivalent savings), decreased foreign consumption demand because of foreign consumer debt load, and decreased domestic demand because of lost savings, the Chinese economy is near the threshold of significant retrenchment. The Bank of Shanghai, a proxy for the Chinese macroeconomic system, appears to be following a July 2021 35/85 of 87/70 week :: x/2.5x/2x fractal decay series with a subfractal (2) 87 week expected low at the end of November 2023.

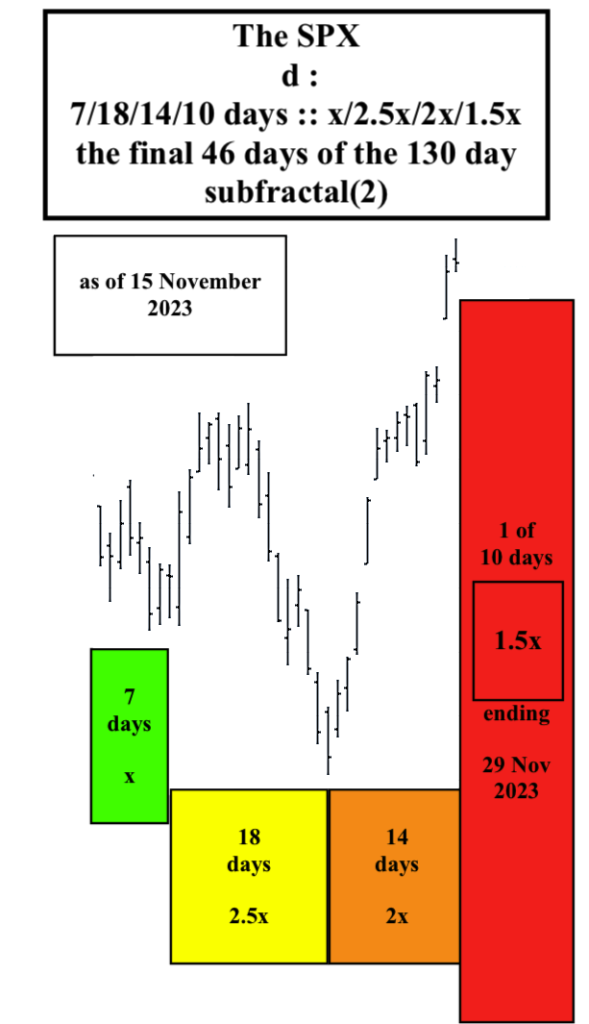

The 13 March 2023 to 29 November 2023 52/121 of 130 day :: x/2.5sx fractal series is depicted below with the current 14 day gain part of a 26 September 2023 7/18/14/1 of 10 day fractal decay series.