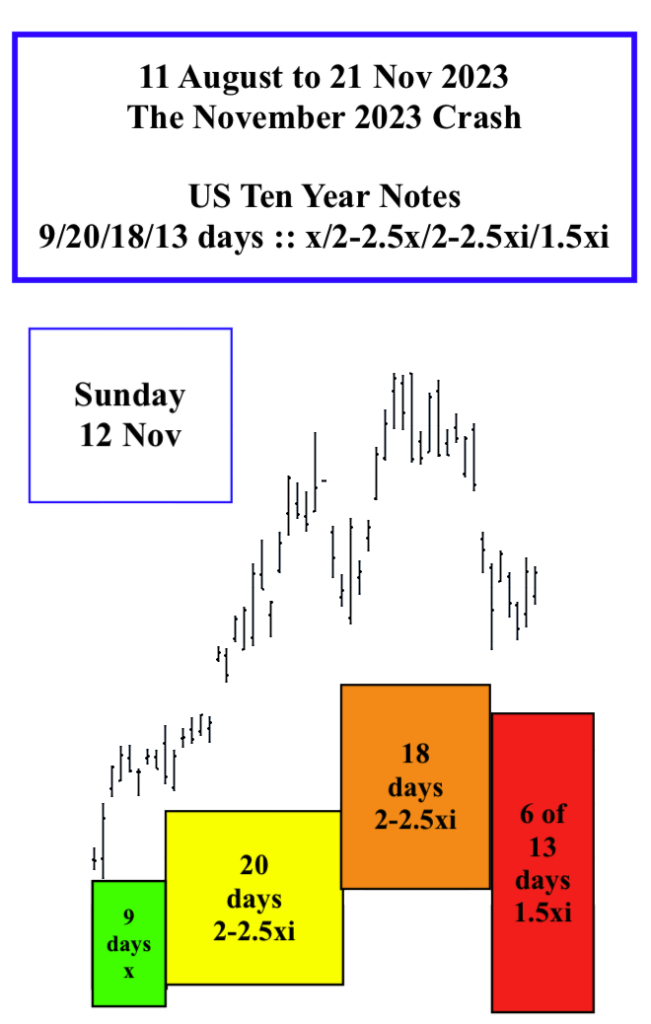

All of the above asset classes – and the inverse for sovereign debt interests, i.e., interest rates have a major interim low ending 21 November 2023.

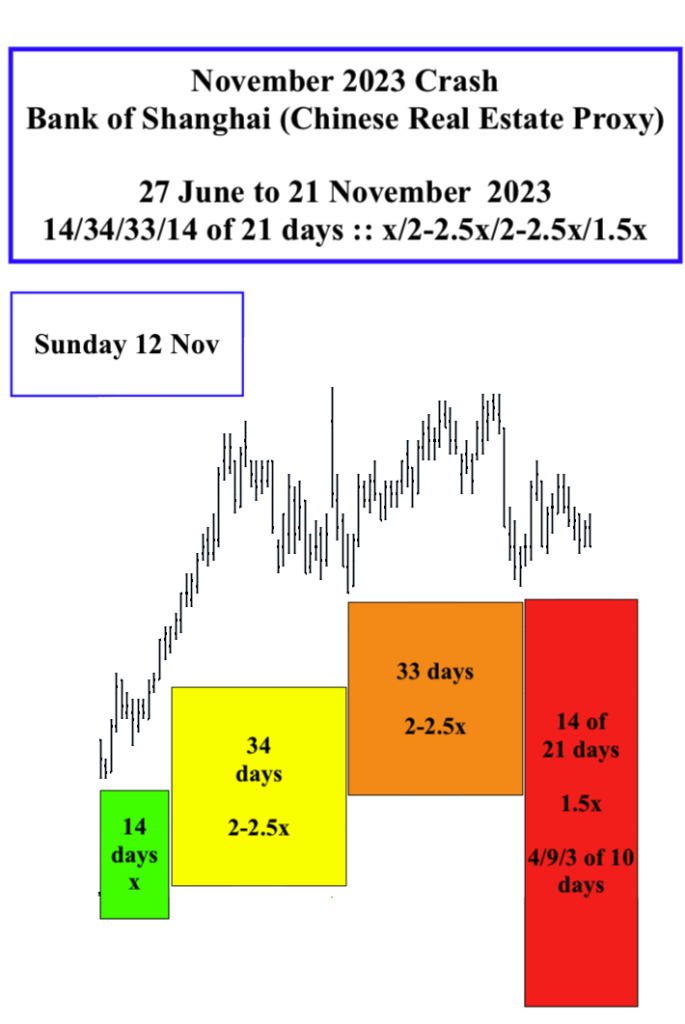

Will the crash devaluation for the above assets be 5, 10, 15, 20, 25%. or more from their current Sunday 12 November 2023 valuations? Time will tell. The Bank of Shanghai should have a 25-30 percent loss from its current valuation.

The asset-debt macroeconomic system, a product of human transaction self-orders the timing of its asset classes’ peak and secondary peak high and nadir low valuations and does in a mathematical fractal pattern just as the universe self orders its parts into structures at different size and time scales: with interaction of subatomic wave-particles; atomic elements; complex molecular organic chemicals; living cells, organelles and tissue within organisms; planetary, comet, and debris interactions within star systems, those systems and black holes within galaxies, and galaxies within the universe.

Underlying the self-assembly of the subcomponents within the size and time scales are the observed elegantly simple mathematical relationships and constants that allow reasonable predictions to be made about the past, ongoing and future interactions at the particular scale.

And so, for buying and selling human transactions of the Asset-Debt Macroeconomic System, more recently strongly influenced by central bank broad QE and QT, elegantly simple mathematical time-based fractal patterns are observed for the system’s self ordering of its asset classes high and nadir valuations.

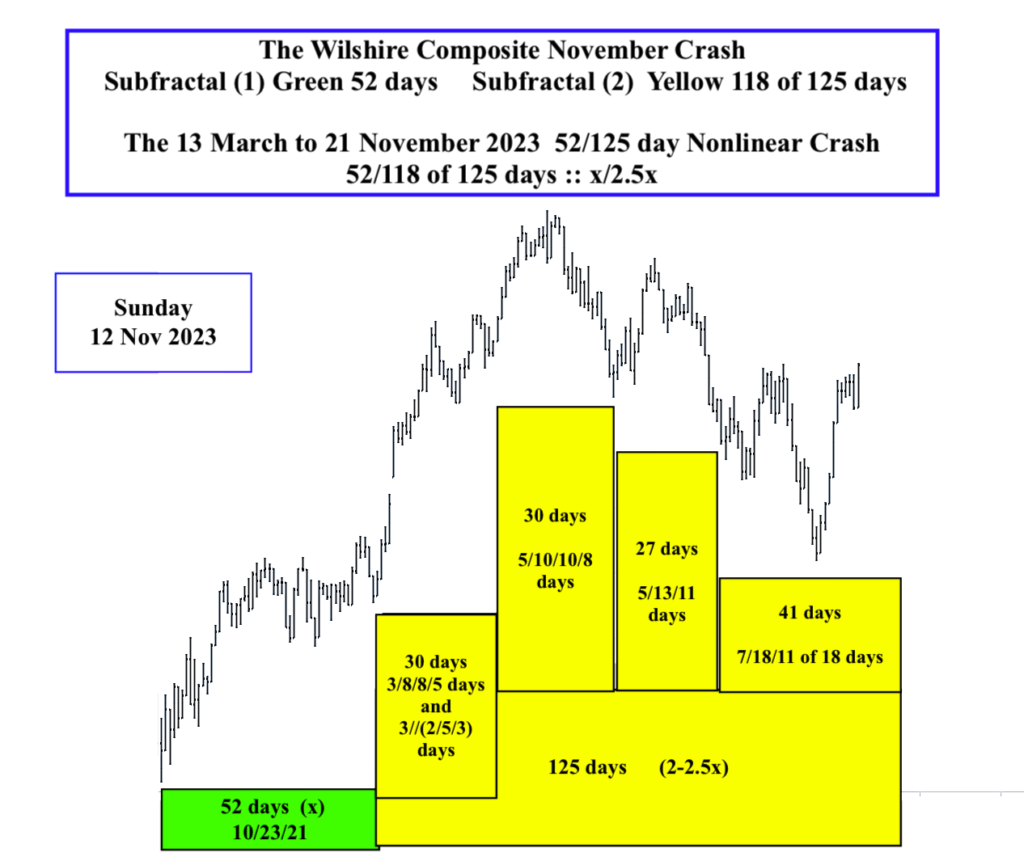

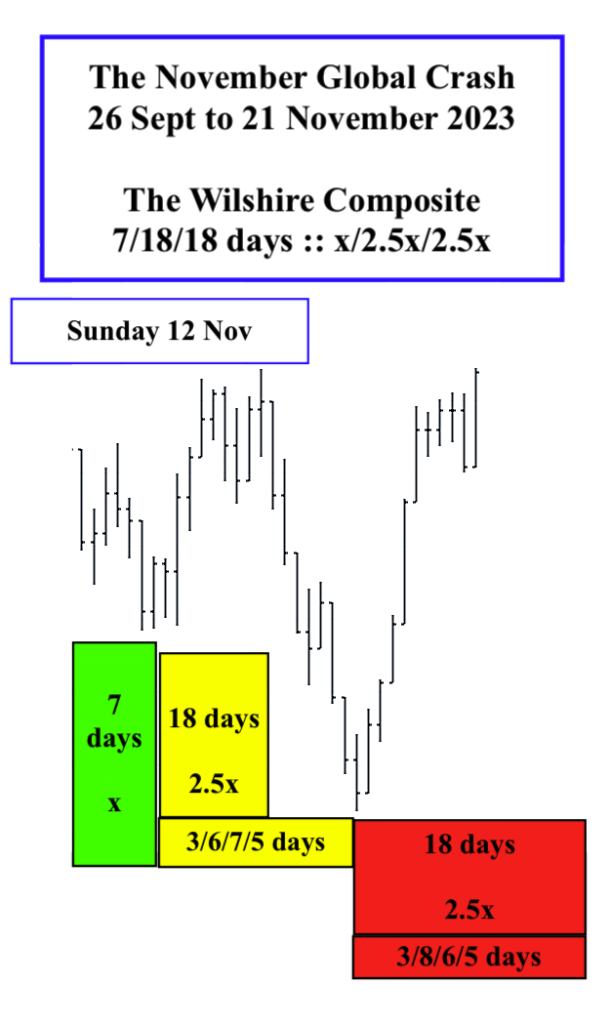

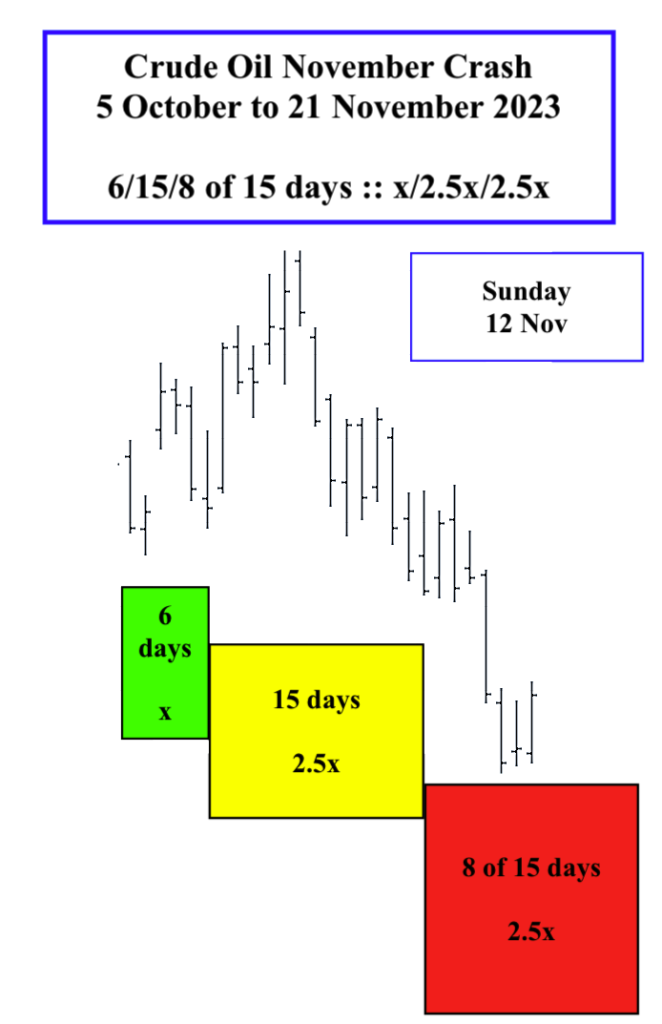

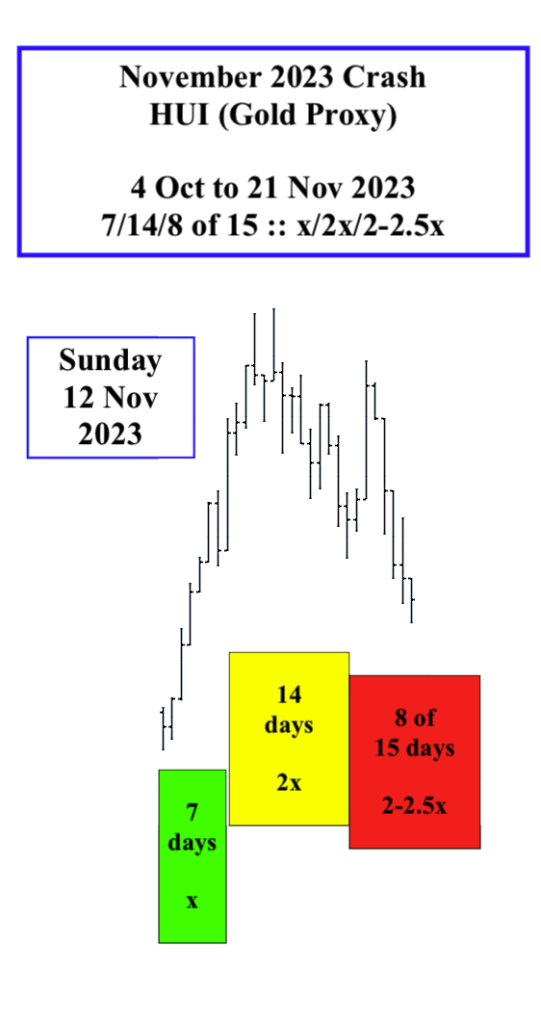

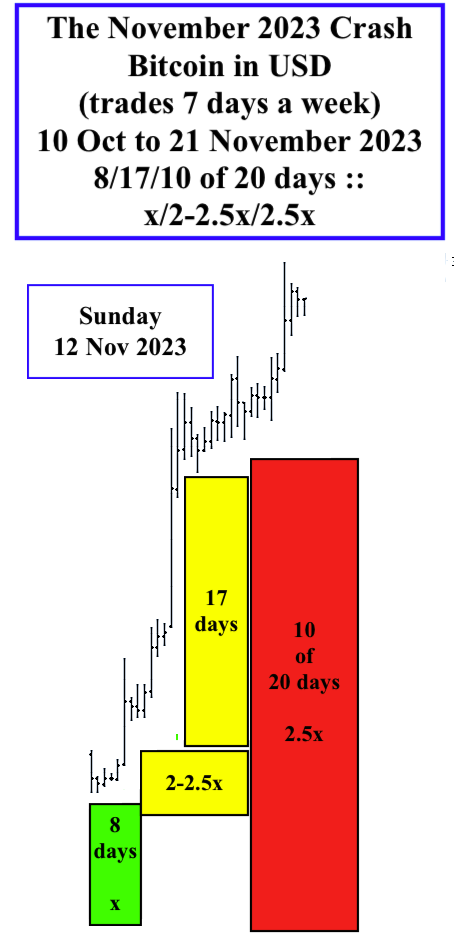

There are only two time-based self-ordering fractal patterns: a three phase fractal pattern of x/2-2.5x/1.5-2.5x and a 4 phase fractal pattern of x/2-2.5x/2-2.5x/1.5-1.6x. Subfractal (3) 2-2.5x of the 4 phase fractal pattern can be a peak valuation in an asset=debt system whose worth is expanding such as the subfractal (3) 90 year peak valuation on 8 November 2021 of a US 1807 36/90/90/54 :: x/2.5x/2.5x/1.5 or it can be a low in system which is undergoing fractal decay which is the current Nov 2023 case with severe QT following in March 2022 after unprecedented QE in 2020.

Using quantum time based fractal progression using the two elegantly simple fractal laws of the asset-debt macroeconomic system listed above, the interim crash low for the Wilshire Composite, the Bank of Shanghai, Oil, Gold, and Crypto is predicted to be 21 November 2023 while the interim low long term sovereign interest rate(higher valuations for previously purchased US Notes and Bonds) is predicted to be 21 November 2023.

The below asset class images and their observed and predicted fractal time progression speak for themselves.