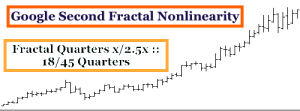

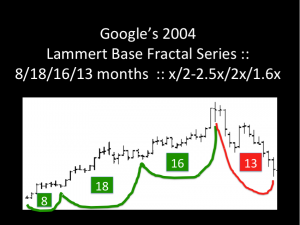

Google’s base fractal sequence (x) starting in 2004 self assembled itself into a classic Lammert Fractal 4 phase growth and decay series lasting 18 quarters. (see graph below: 3/7/6/5 quarters =18 quarters) The maximum length of a second fractal series is 2.5 times the base sequence (x). For Google with a first fractal base sequence of 18 quarters, the maximum length of the second fractal is 45 quarters x/2.5x ::18/45 quarters.

In October 2019, Google entered the time period of its second fractal’s 45th quarter. Google’s 45 quarter second fractal is composed of two sub fractals, the first of 13 quarters and the second of 33 quarters. This also is a x/2.5x sequence of 13/33 quarters.

In October 2019 Google entered the 33rd quarter of its 45 quarter second fractal x/2.5 ::13/33 quarter sub fractal series.

From the face page of the 2005 Economic Fractalist:

The ideal growth fractal time sequence is X, 2.5X, 2X and 1.5-1.6X. The first two cycles include a saturation transitional point and decay process in the terminal portion of the cycles. A sudden nonlinear drop in the last 0.5x time period of the 2.5X is the hallmark of a second cycle and characterizes this most recognizable cycle.

Expect the expected which the elegantly simple patterned science of saturation macroeconomics allows prediction.

The global asset debt macroeconomic system is elegantly quantifiable and deterministic in its intrinsic nature. Its assets grow in sequential fractal and sub fractal units to their necessary maximum valuation saturation areas which underlying debt expansion can produce with thereafter necessary devaluation in a Gompertz fractal manner.

The December 2018 Great 4th Fractal Blow-off and Collapse:

The final daily fractal sequence for the US SPX proxy for global equities’ valuations since the low in December 2018

is a x/2.5x/2.5x/1.6xy fractal sequence :: 32/79/77/52 days with a blow-off gapped high peak valuation in the 4th fractal 1.6xy 52 days following a daily fractal sequence of 15/29/24 /18 days x/2x/2x’/1.5y’ which contains the terminal portion of the 77 day lower higher 3rd fractal and the final 52 day 1.6xy 4th fractal. The ideal base of with a 29 day second fractal is 12 days equaling a base of x’. 2x’ is equivalent to 24 days. There have been gapped higher highs in the last 2-3 trading days for the DAX, the NIKKEI, the CAC, and the SPX heralding the usual final technical blow-off peak valuations. The 18 day 1.5y’ 4th fractal with a x’ 12 day base represents a nonlinear collapse with gapped lower lows expected to take the SPX below the November 2016 presidential election valuation level.