APRIL 2013 as the US Grand 155 year 1858 second fractal terminus will be a combination of October 1987 and October 1929.

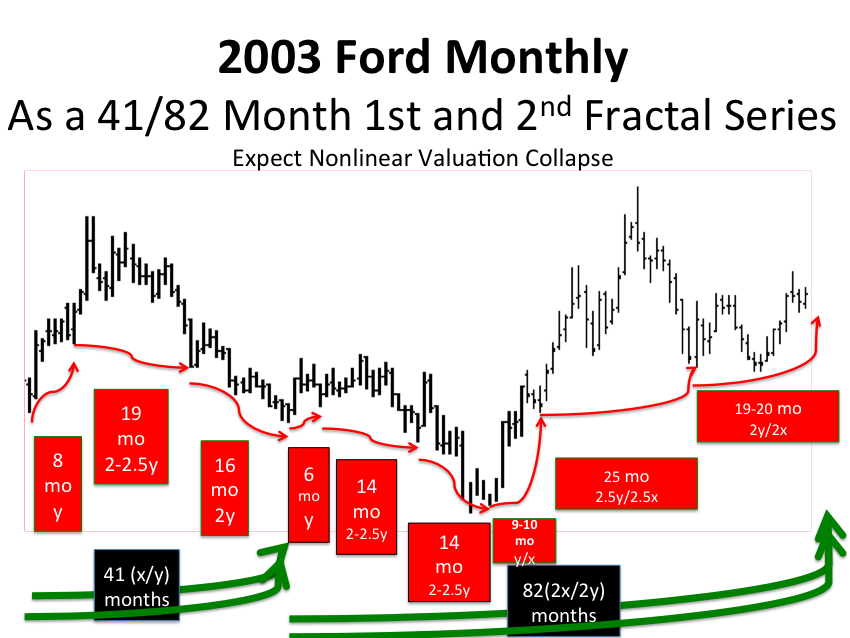

For Ford Motor Company, April can be viewed as a 2003 41/82 :: x/2x month first and second fractal series.

As Ford Motor Company goes, so potentially, without Dr. Bernanke’s involvement, goes the lot of the US and global citizen workers.

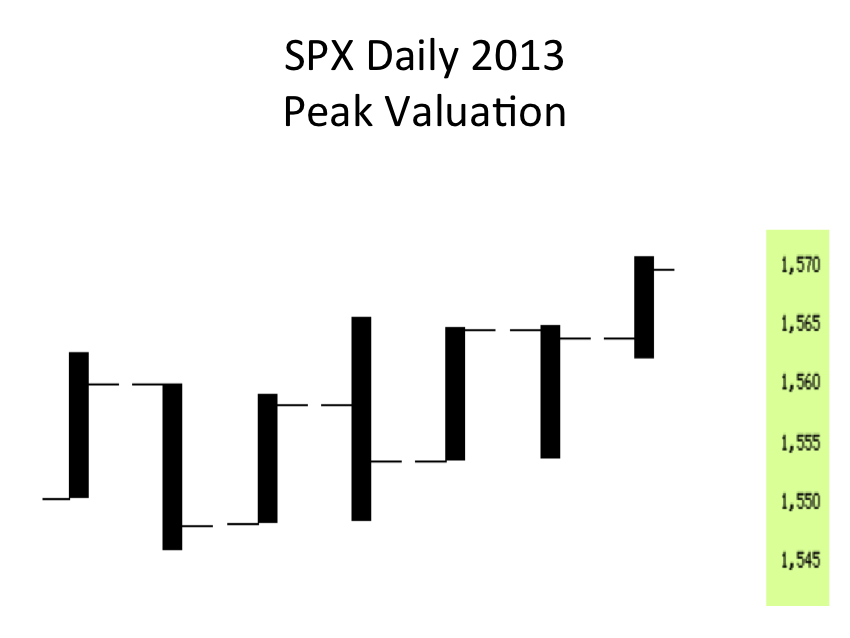

A Fractal Analysis of the SPX Peak (secondary peak) Valuation.

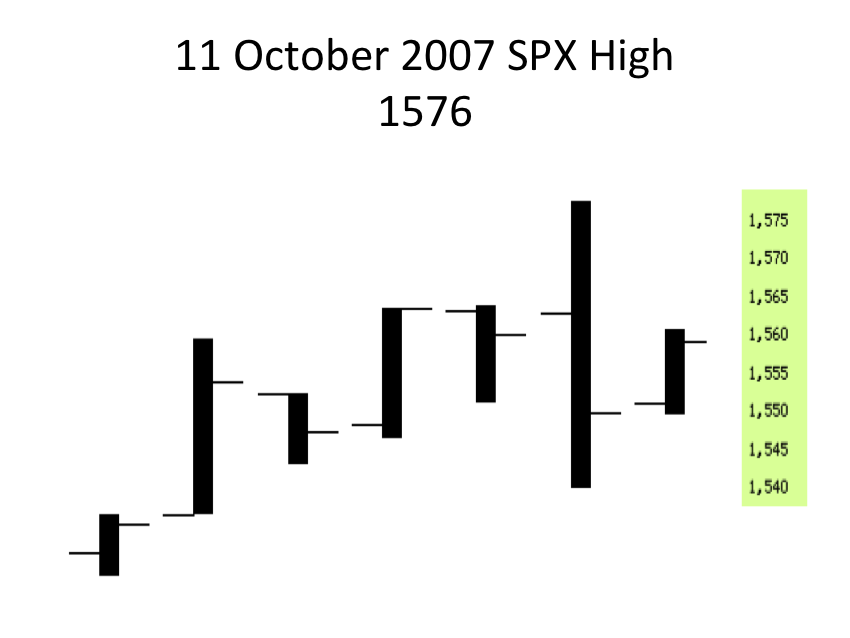

With Reuters, mouthpiece for the elite, spouting a war declaration by North Korea on South Korea, 28 March 2013 may have been the SPX’s secondary high, secondary to 1576 reached on 11 October 2007.

The US central bank is doing what it must do and ethically and asset-debt system practically should do, supporting the system with currency, trading US dollars directly for ongoing jobs.

Dollars, traded for and denominated in, US citizen jobs represent the ultimate basis for money as a trading device in the asset-debt system. The Adam Smith fundamental system has long been leveraged away and subterfuged by the gaming of the financial money changers. The current Federal Chairman wisely understands a US Real Bills doctrine where valued work and services are exchanged for the sovereign’s currency.

A large group of politicians do not.

The ‘money printing’ of the US central bank directly represents labor and service value within the macroeconomy. The money generated and owed is money generated and owed to the citizens. It is, in fact, debt jubilee money.

With this money creation, there will be no hyperinflation. Money created for citizens’ services merely sustains the system and pays off (private) asymptotic debt that now exists in the system. The Rentier class, the fractional lending banks, the transgenerational wealthy beyond reason private citizens, and large sovereigns are the recipient principal beneficiaries of keeping citizens employed and repaying debt and rent and continuing the current asset-debt current contracts and laws.

With complete asset-debt system collapse, employment of the masses will take on a North Korean approach and generalized hostilities and rhetoric will escalate to a nuclear winter scenario.

This is the natural historical progression of all completed asset-debt credit cycles. There is a possibility to avoid this scenario with sovereign banks or private banks and associated leadership having the big picture wherewithal to employ citizens via positive use of sovereign currency for sovereign and global useful activities.

Is the global, now internet connected, collective – smarter than following the old familiar Napoleonic pathway to global war?

Was 28 March 2013 the 11 October 2007 secondary top for the SPX?

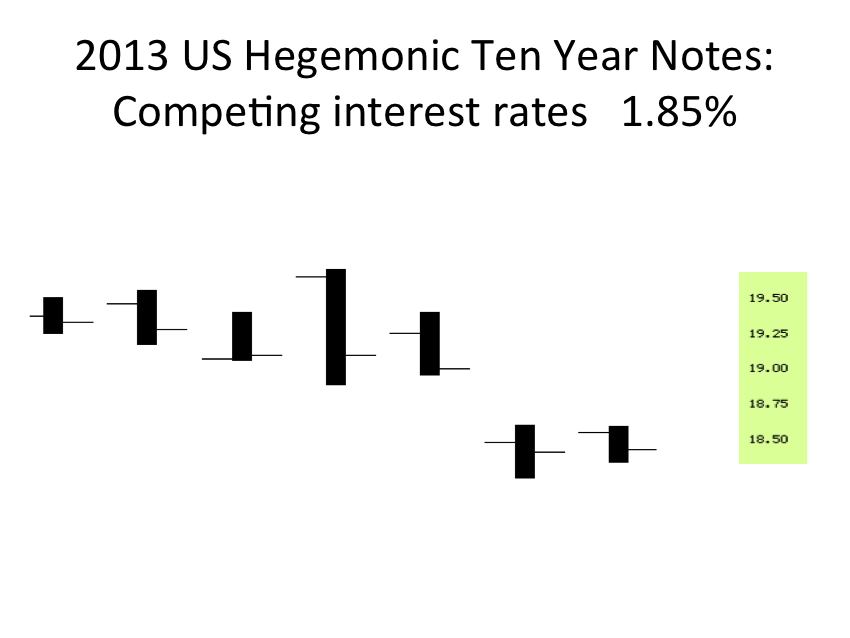

The tax, business, and legislative rules of the asset-debt macroeconomic system and the natural course of lower demand under the asymptotic maximal debt umbrella of 2008-2013, have progressively lowered interest rates which compete directly and attract the ‘investor population’ more focused on equity and commodities – with resulting asset valuation bubbles.

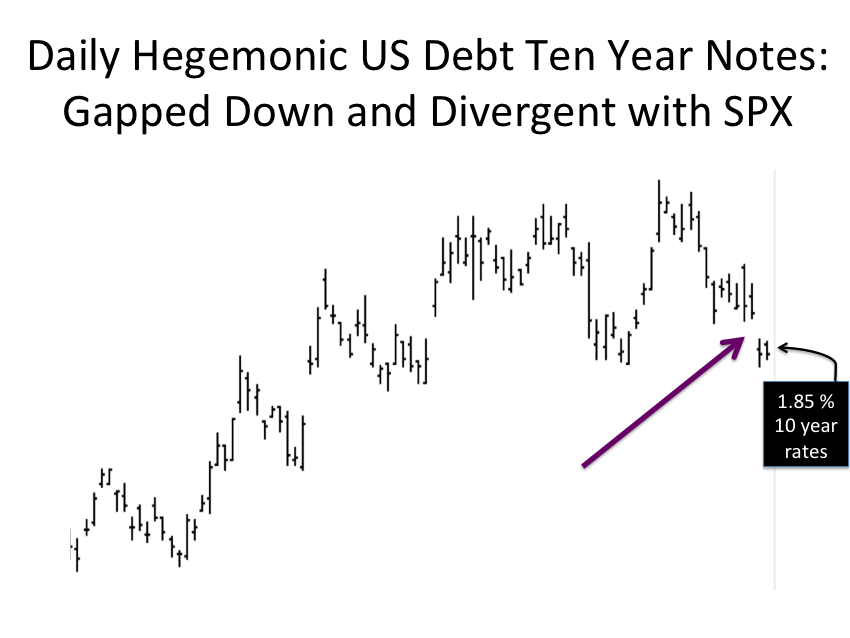

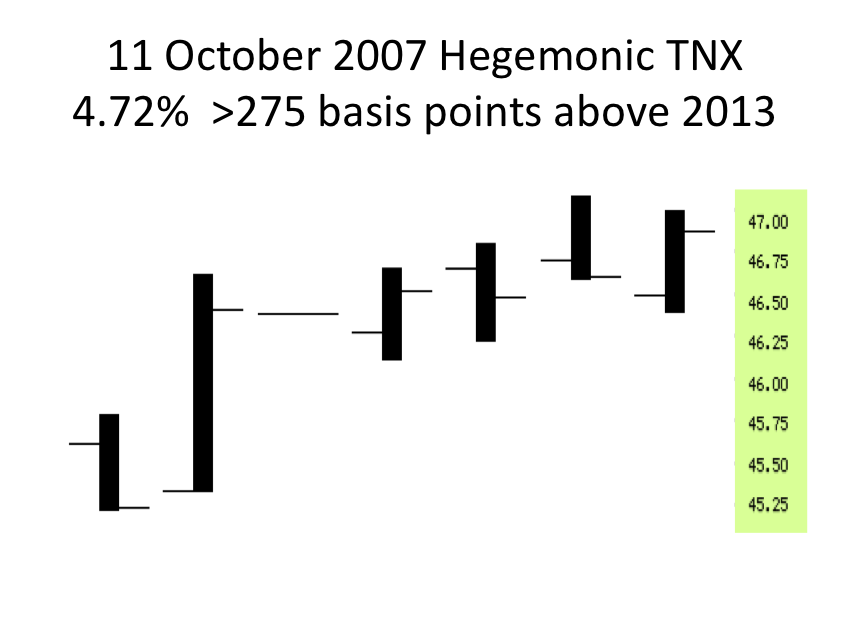

The answer is in the dominant SPX-diverging hegemonic TNX and TYX fractal series.

Is this a TNX/TYX reciprocal 5-/10/3 of 8-10 day of 10 blow-off or a 5/11 to12 of 12 to13/7-10 day blow-off?

Time will tell.

Just who are the 190 trillion dollar equivalent of global debt Counter Parties? And … do they feel they have enough control of the situation to maintain their family transgenerational wealth for the 21-25th centuries in a scenario of a nuclear winter?

Time for them to step up and influence their subordinates into win-win-win scenario.