‘who are 2013 shoeshine boy equivalents?’

Stock market crashes matter greatly in the asset-debt macroeconomic system: wealth used as collateral in the real economy and essential for future debt expansion is sequestered and concentrated in the hands of the Wall Street Few – advantaged with both knowledge of crashes and high speed computers and trading programs….

The LAMMERT PATTERN OF GROWTH: From the MainPage of the Economic Fractalist

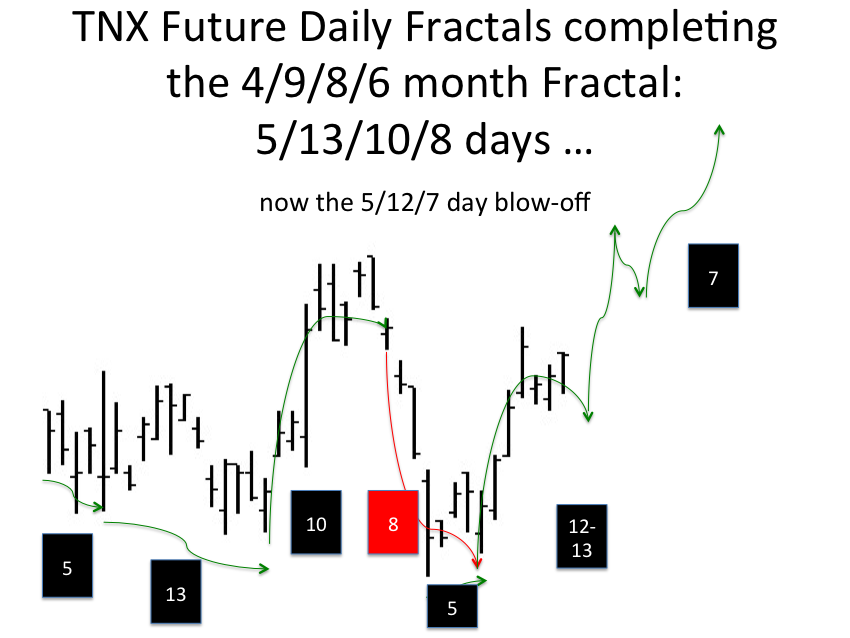

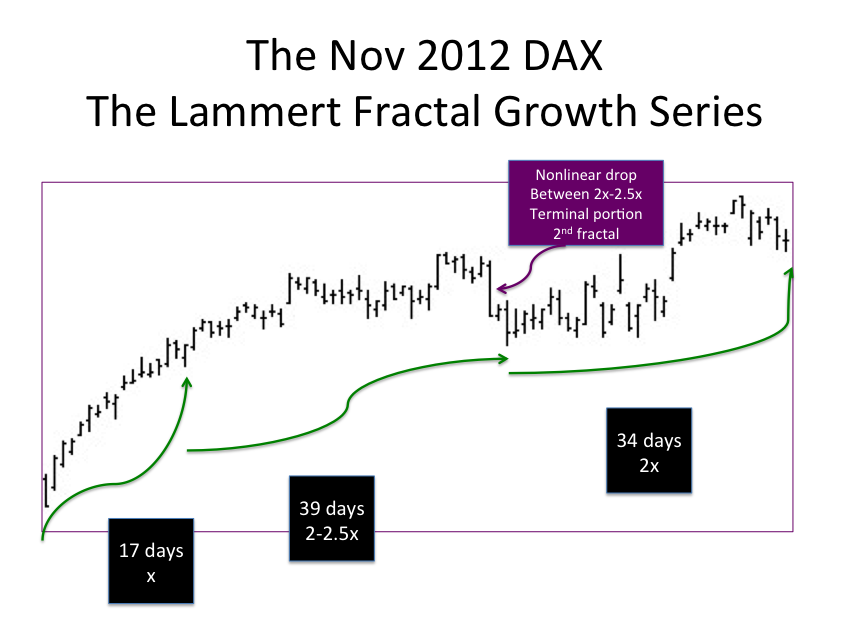

The ideal growth fractal time sequence is X, 2.5X, 2X and 1.5-1.6X. The first two cycles include a saturation transitional point and decay process in the terminal portion of the cycles. A sudden nonlinear drop in the last 0.5x time period of the 2.5X is the hallmark of a second cycle and characterizes this most recognizable cycle. After the nonlinear gap drop, the third cycle begins. This means that the second cycle can last anywhere in length from 2x to 2.5x. The third cycle 2X is primarily a growth cycle with a lower saturation point and decay process followed by a higher saturation point. The last 1.5-1.6X cycle is primarily a decay cycle interrupted with a mid area growth period. Near ideal fractal cycles can be seen in the trading valuations of many commodities and individual stocks. Most of the cycles are caricatures of the ideal and conform to Gompertz mathematical type saturation and decay curves.

G. Lammert

This page was last updated on 15-May-2005 01:21:59 PM .

Money flow in the one quadrillion asset debt system is defined by the rules of the system which preferentially favor particular asset money flow. Ultimately the population pool of ‘speculators’ interested in the favored asset are completely depleted. No buyers are left and a natural collapse of asset valuation occurs with money equivalent becoming concentrated in the peak sellers.

Musings of an Economic Fractalist:

In 2010 the worth of the US working citizen’s economic world in wages and salaries totalled $6,009,831,055,912.11 about 6 trillion dollars.

Total US debt was about 52 trillion and US total asset worth including debt was 190 trillion.

The 52 trillion of US debt is shared by 4 groups: citizens, government, corporate business, and financial industry. Private citizen debt includes real estate, education, and credit card debt. The debt passed by the authority of the government is immediately transferred to the citizens debenture liability column. Corporate debt repayment is dependent in a large part on citizen consumer health to purchase corporate based goods and services. Financial Industry too-big-to-fail debt has been blank-check underwritten by the government again immediately transferring the debt liability to the citizen who has been given the responsibility for Wall Street’s money-gaming, system-gaming IOU losses.

The value of the other 140 trillion of assets is denominated in the integral sum of all of the US asset-debt macroeconomy’s parts including both assets and debt as an asset and the small contribution of ongoing wages of the citizens.

The net result is that the citizen based real economy of 6 plus trillion in wages is both key in supporting the solvency of Counterparty’s 52 trillion dollars of debt, the ongoing value of individual asset within the system, and the resulting total value of the 190 trillion dollar US asset debt system. Those ongoing wages reciprocally are dependent upon the valuation of the minority percentage of hard assets (38 % or less) owned by 95 percent of citizens who use that valuation as collateral for ongoing new debt creation which creates the majority of ongoing demand in the real citizen’s economy.

The US is a substantial microcosm of one quadrillion worth total value global system with total world debt at 190 trillion equivalent dollars.

The counterparty’s wealth and loaning usury fees on 190 trillion exceeds the citizen’s real economy, their total worth, and dwarfs their ongoing wages.

When the mathematically necessary asset-debt system apoptosis occurs – at the time when speculative ‘investment’ has progressed to the extent to completely deplete the pool of interested and buying speculators – valuation of the overvalued speculative asset collapses.

The winners of the asset collapse are a small group of Wall Streeters with both the wherewithal of the timing of natural asset valuation collapses within the asset-debt system and with the computerized trading programs and direct linkage to the system which ensures the complete rape of small ‘investors and the financial industry’s targeted well-propagandized and ingrained group: the buy-and-hold 401ker’s.

This sequestered wealth representing a life time of earnings and ‘savings’ is transferred and concentrated in a small population whose consumer activity in the real economy represents a very small fraction of the destabilized 401ker consumer citizen activity. With wealth further concentrated in a much smaller population, broad based demand in real economy plummets.

Yes, stock market valuation crashes have a direct and tremendous effect on the real operating citizen economy.

Beyond the little maggots of Wall Street and the Financial Industry are the real Counterparties of Global Asset Wealth and Majority Owners of the US 190 trillion dollars of assets and the 52 trillion of US debt and 190 trillion of global debt whose repayment ultimately rests on citizen consumer activity in the real economy.

The working US citizens with their 6 Trillion dollars of wages against 190 trillion of US assets including 55 trillion of debt represent a 21st century sharecropper equivalent of the Counterparty’s who have amassed their titanic wealth and lending authority and positions via transgenerational transfer of wealth and ownership of transgenerationally-wealth-protecting legislatures and laws.

Who are the Counterparties who own the 52 trillion dollars of US debt? Who are the global counterparties who own 190 trillion dollar equivalents of global debt?

Further Musings ….

Caenorhabditis elegans and Equivalent Naturally-Occurring Elegantly-Patterned Nonlinear Apoptosis in the Asset-Debt Macroeconomic System

Apoptosis is “programmed” cell death. It involves a gene based, deterministic, and sequentially timed elimination of particular cells.

In the embryology of the microscopic nematode Caenorhabditis elegans, from the initial cell division, there are a total of 1090 cells that arise to form the tiny organism.

Of the 1090 somatic cells generated in the formation of the adult worm, 131 cells undergo apoptosis or “programmed cell death.” These 131 cells die at particular points during the development process, which is consistent between worms demonstrating a remarkably deterministic self assembly system. The 131 episodes of self assembly programmed cellular death occur in less than 12 hours.

For the asset debt macroeconomic system equivalent programmed and ordered apoptosis involving systemic asset valuation collapses and generalized debt default occurs likewise deterministically with an equivalent clock for major collapses in measured in years and decades rather than hours.

Investment money equivalents are preferentially drawn to the system’s tax advantaged, rule-advantaged favored asset or asset class until the investor pool for that asset has been entirely consumed – at which point asset valuation collapse occurs. The consumption of the investor proceeds in a quantum mathematical ordered fashion. After depletion asset valuation proceeds likewise in an ordered fashion with quantum reentry into the market with counter growth periods within an other all asset valuation collapse.

The asset debt system manner of asset valuation growth proceeds in a time based quantum fractal manner as was described in the 2005 Main Page of the Economic Fractalist and as is clearly demonstrated in the November 2012 DAX denominated in days.

Dramatic nonlinear apoptotic-equivaent valuation collapses occur in the terminal portion of the asset-debt system’s second fractals. The degree of collapse is proportional to the length of time based units : minutes, hours, days, months, years, and decades.

The US is currently in the terminal portion of a 70/156 year 1789 first and second fractal series. Transgenerational wealth laws have allowed global wealth and ownership of debt as an asset to be concentrated in a smaller and smaller percentage of the population.

When asset collapse occurs, the citizen US real economy which produces about 6 trillion in wages will be disproportional affected as Wall Street sequesters wealth from the 401k masses and life insurances holdings. With the 190 trillion dollar US asset-debt system dependent on its base citizenry for debt dependent forward consumption, the further concentration of wealth will diminish the system’s ability to have the collateral needed for future broad based citizen consumption.

Like programmed individual cellular death of the nematode, the organism survives but the structure is bent.

After the crash: the global challenge will be finding societally useful alternatives to the post crash customary military employment of the masses in global warfare., attacking another country rather than directing attention to wealth and debt holders and rule makers who have caused so much misery.

A citizen debt jubilee and a national real bills doctrine would go a long way to immediately jump starting the economy. Trading currency directly for useful economic activity and denominating the value of the currency in citizens’ services, labor, and production is a rational basis for a new credit cycle.