.. and the Wall Street Financial Industry ‘economy’ disconnected from the real economy…

That was in 1929, at the height of the first 75 year sub fractal growth series for the US 1858 156 year second fractal. The second subfractal growth series started in 1932 and has proceeded in a 15/37/32 year :: x/2.5x/2x+ Lammert Quantum Growth Series fashion.

At the end of this US 156 year second growth fractal lies a 1987 type of second fractal valuation nonlinear collapse for global equities, non US dollar currencies, commodities, gold and silver – with the Asset-Debt Global Macroeconomic System’s Countervailing Quality Asset: US Debt – on the receiving end of surviving asset money equivalent influx, with US interest rates evolving to historical 230 year lows.

Is the Asset Debt System at its transition point where the speculative asset valuation has reached its self assembly natural quantum time peak – correlating to the exact time frame when the population of speculators has been exhausted?

Likely so.

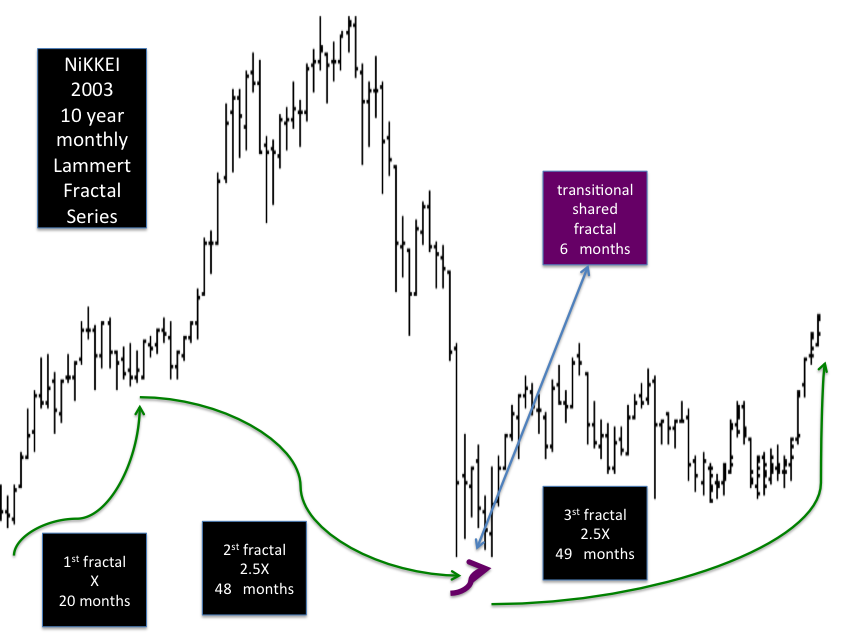

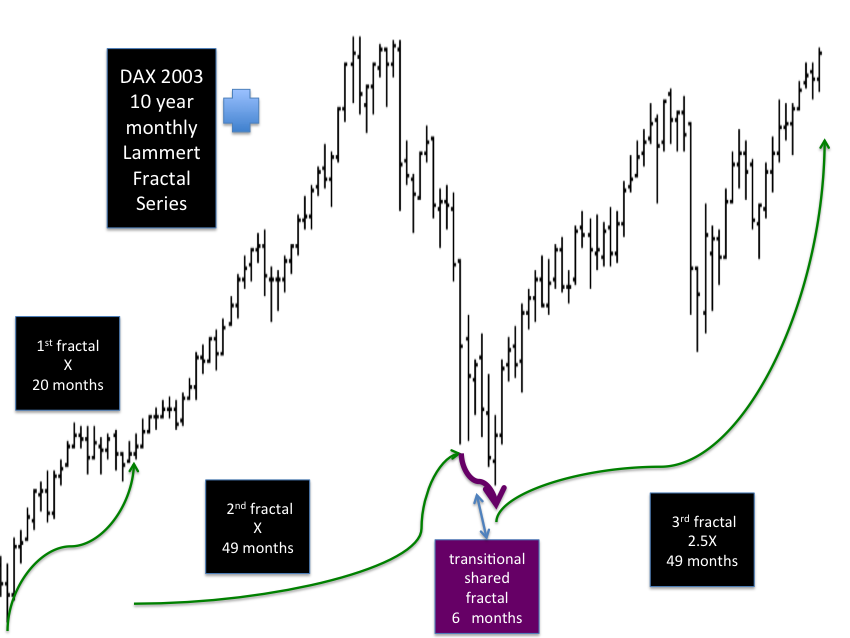

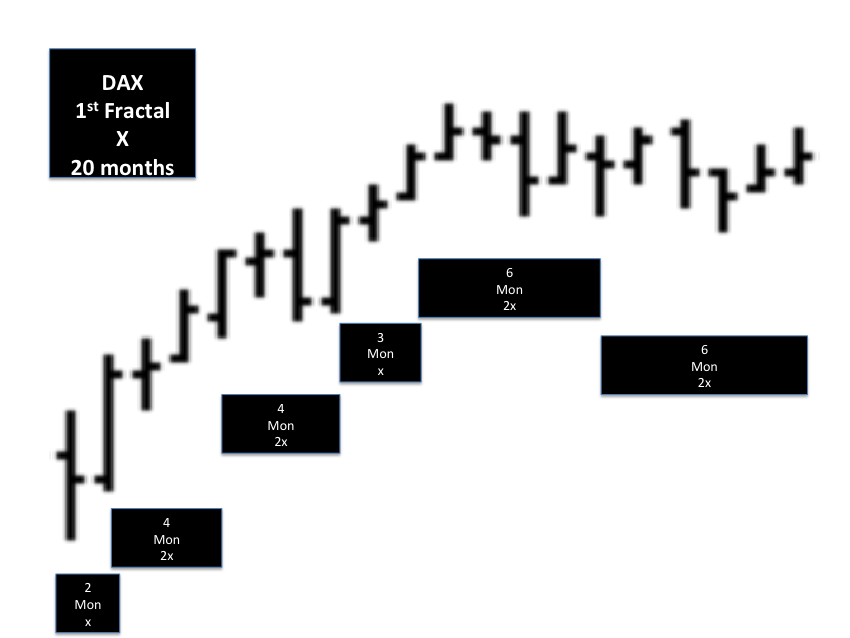

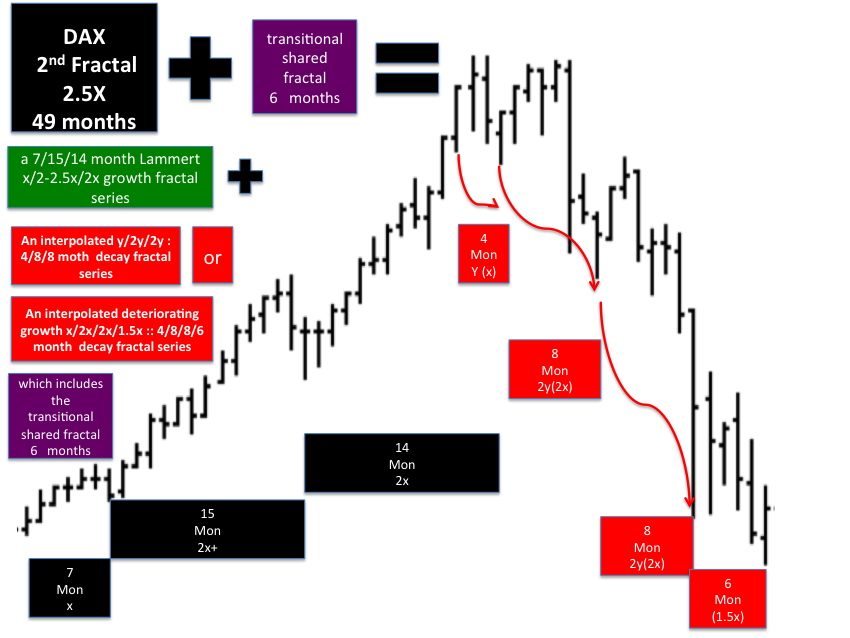

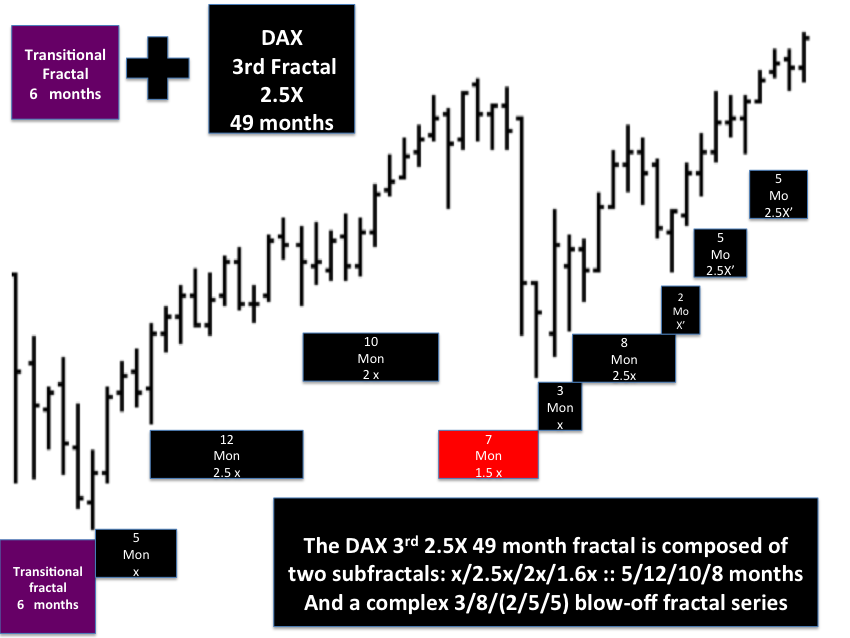

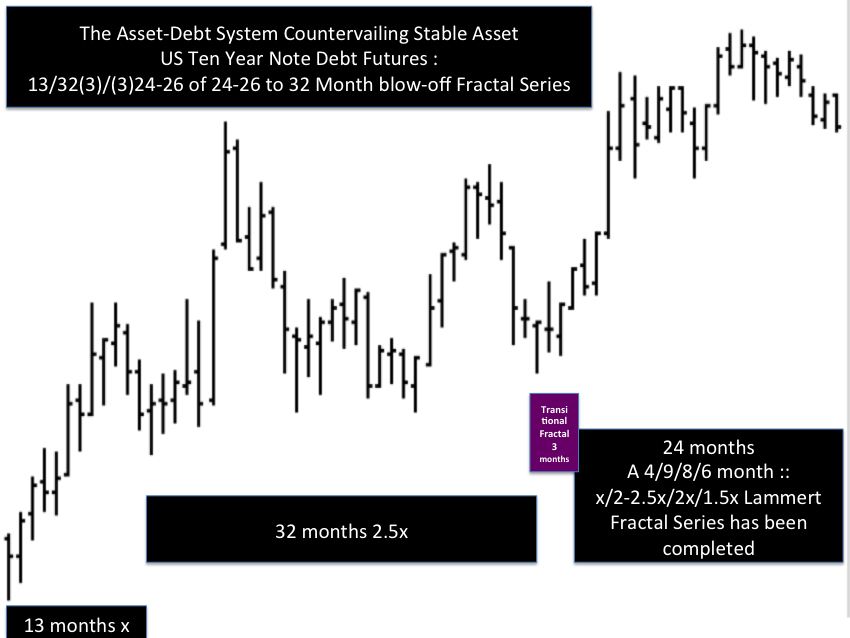

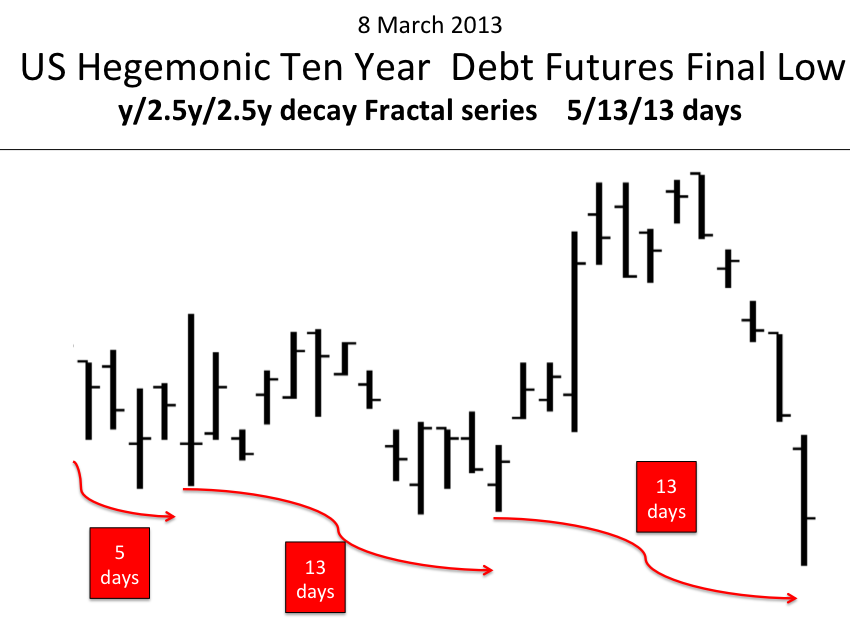

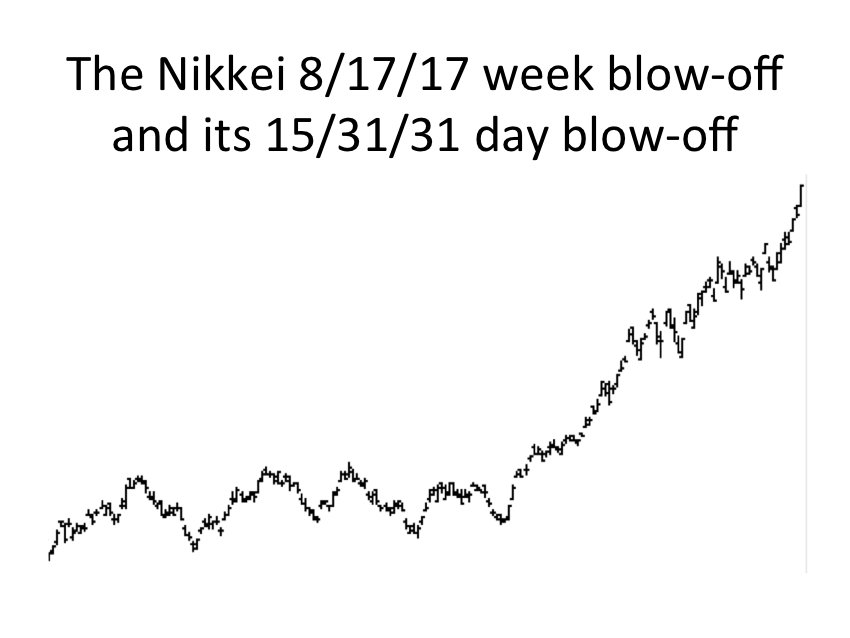

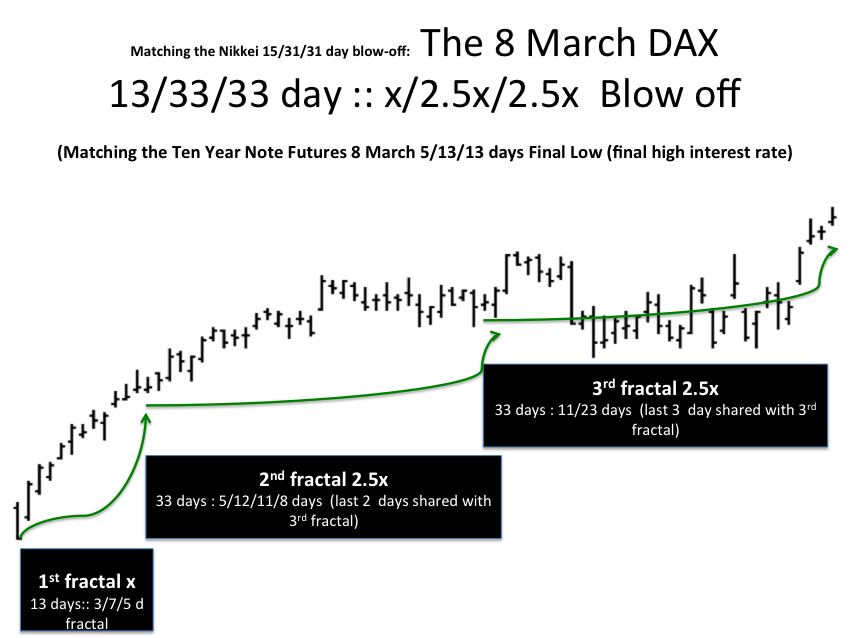

The 8 March 2013 natural timing conclusion of the countervailing US hegemonic Ten Year Note Debt Futures of 4/9/8/6 months :: x/2-2.5x/2x/1.5x and 15/37/29/22 weeks :: x/2.5x/2x/1.5x and 5/13/13 days :: x/2.5x/2.5x matches the exact timing of a 15/31/31 day blow off for the oppositional speculative Nikkei and the oppositional 13/33/33 day :: x/2.5x/2.5x and 20/49(6)/(6)49 month x/2.5x/2.5x DAX.

The Swiss Franc has also concurrently reached a 17/37/34 month critical time frame with its expected collapse devaluation against the hegemonic US dollar.

Examine the NiKKEI, DAX, and countervailing US TEN YEAR FUTURES long term and short term interlocking oppositional time based asset valuation evolutions. It’s time.

Observe the 2013 quantitative time based patterns above and the qualitative similarities of the real economy to the Wall Street Financial Industry speculative bubble – similar to the peak time of the 1858 US second fractal equity progenitor first subfractal peak growth in 1929 as the documentary describes.

This is a (worse) replay of 1929, save for the understanding of the current Chairman of Federal Reserve, who has enormous power to promote beneficence in the real economy.

On the other hand, The Financial Industry recognizes what is happening. They are 50:1 sellers to the frenzied small speculator buyers. With US Second Fractal 155 year nonlinearity this will represent the greatest transfer of delta wealth delta time in recorded history.

Money ultimately denominated in citizen labor and services in the real economy will be transferred to the electronic accounts of whom are best described as the moneychangers money mongrels.

These mongrels provide worse than no real use to the real citizens’ economy: they manipulate the money system and skim wealth exactly equivalent to that denominated in real goods and real services in the real economy via derivative and stock and commodity trading and money manipulation without productive labor from the money-debt system.

They leverage their bets via advantaged laws and financial schemes created by their control of the political system. These bets created the most damaging bubble that involved the primary wealth asset of the individual citizen, the private residence, destroying the basis of the citizen’s forward based economy chief foundationalsaving’s vehicle.

They now influence and force citizens thru established tax laws and control of communications hawking their derivatives, putting the small speculator on the opposite side of their short sell, and directly stealing money from citizens during known times of market saturation and nonlinear asset valuation collapse.

This is the time of the GLOBAL FINANCIAL INDUSTRY’s GREATEST EVER SEQUESTER of the Asset-Debt Macroeconomic System’s electronic wealth.

For the masses of American citizens, even before residential ownership, the transportation to work vehicle represents the major necessary purchase item for the working citizen.

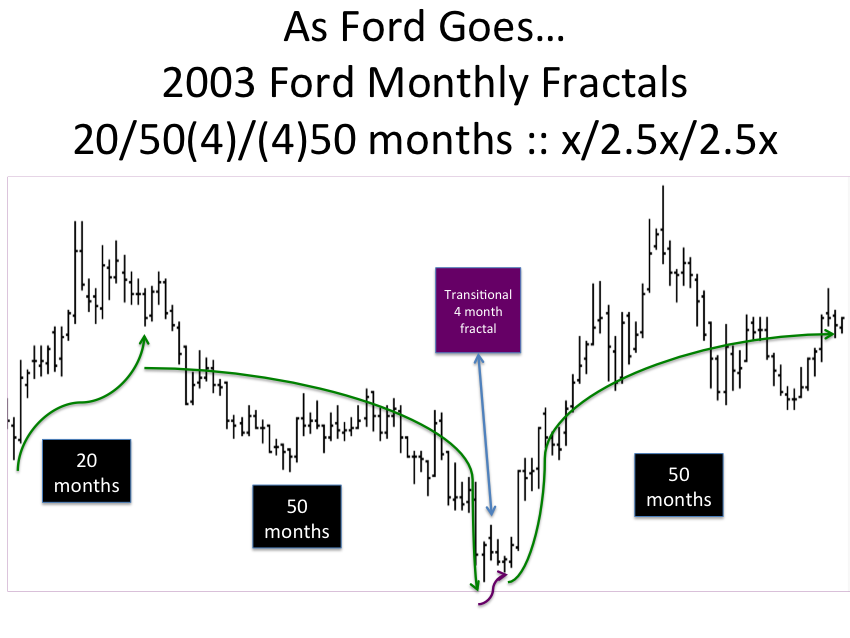

As Ford Goes ……….. So Goes ………. The foundation for the Global Consumer-Citizen Labor-Based Asset-Debt Macroeconomic system…

Vehicle company equity valuation time-based saturation curves represent the qualitative bell weather indicator for the consuming health of the US working citizen population, proxy for the working citizens of the world.

These US citizens’ 13.5 trillion dollars of services and labor both form the basis for the worth of the US dollar and provide the principle collateral for the forward consumption related debt in the larger one quadrillion dollar equivalent.Asset-Debt Macroeconomic System.

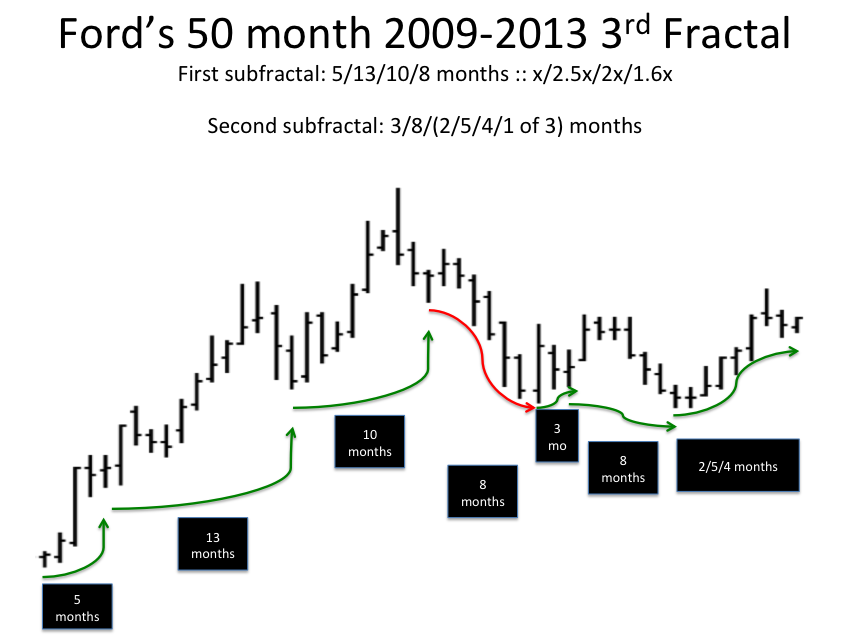

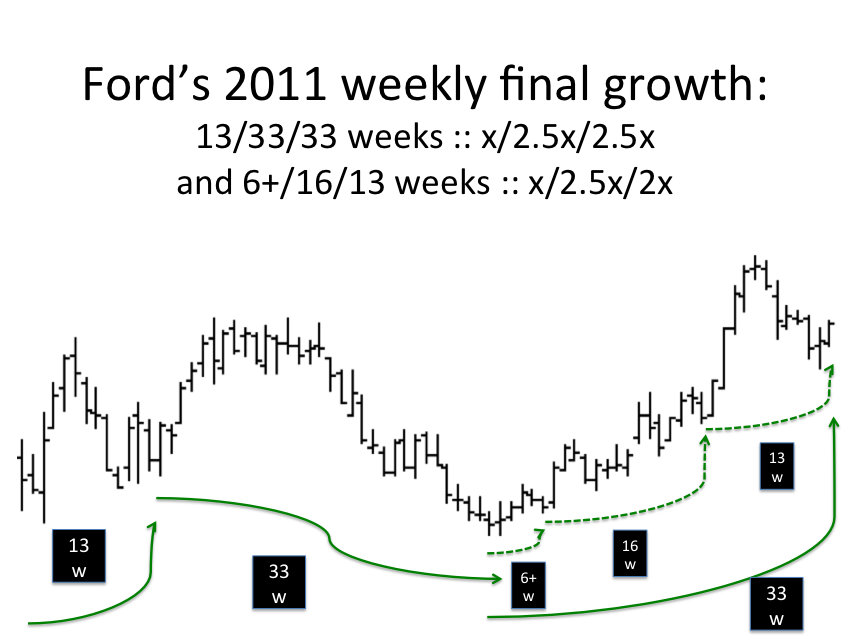

The 2003-2013 elegant Lammert 3 phase maximum growth: x/2.5x/2.5x ::20/50/50 months are shown below for Ford.The last 50 month third fractal starting in 2009 is composed of two subfractal series: a perfect 5/13/10/8 month :: x/2.5x/2x/1.6x Lammert fractal series and a more complex 13/33/33 week fractal series :: x/2.5x/2.5x starting in the last week of September 2011.

The last 33 weeks is composed of a 6+/16/13 week :: x/2.5x/2x growth series… Terminal Ford valuation growth is timed as is the Nikkei blow-off and DAX blow-off with the 8 March 2013 5/13/13 day and 4/9/8/6 month final low valuation (high interest rates) of the Hegemonic US Ten Year Note, the Asset-Debt System’s countervailing quality asset.

All other nondollar and non US debt assets will crash in value during system wide debt default and asset overvaluation collapse just as occurred in the US 1858 second fractal’s first 75 year subfractal series peaking in 1929….

As Ford Goes, so Goes the US and Global working citizen’s working opportunities as the Asset-Debt Macoeconomic System’s real demand for citizen labor and services plummet.