Saturation Economics…..

From the Main Page of the 2005 The Economic Fractalist

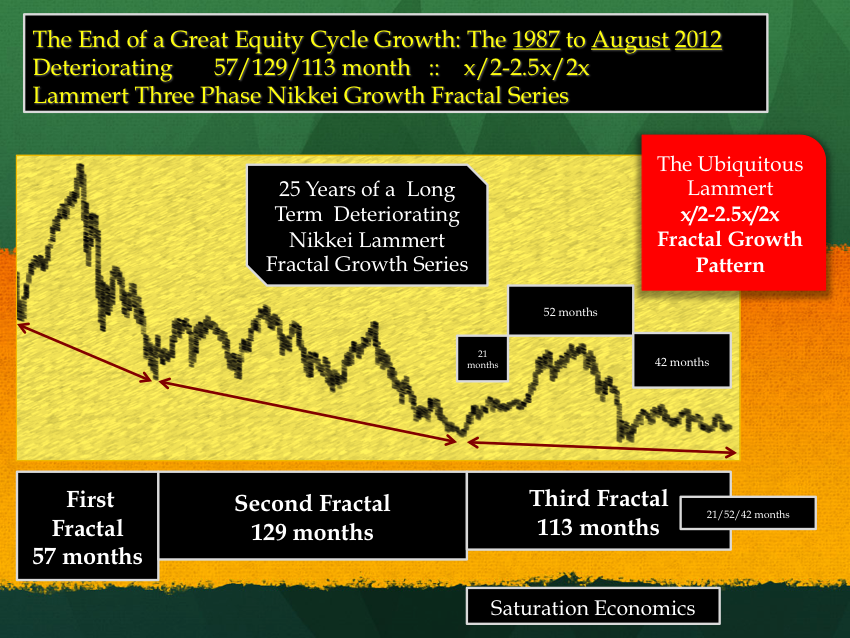

“The ideal growth fractal time sequence is X, 2.5X, 2X and 1.5-1.6X. The first two cycles include a saturation transitional point and decay process in the terminal portion of the cycles. A sudden nonlinear drop in the last 0.5x time period of the 2.5X is the hallmark of a second cycle and characterizes this most recognizable cycle. After the nonlinear gap drop, the third cycle begins. This means that the second cycle can last anywhere in length from 2x to 2.5x. The third cycle 2X is primarily a growth cycle with a lower saturation point and decay process followed by a higher saturation point.”

How much of the world’s private debt, business debt, poor country sovereign debt, state debt, county debt, city debt, European debt – how much of this accumulative debt is bad debt -that which can not be repaid?

The global debt-asset macroeconomic system is mathematically self assembling in its countervailing asset saturation curves to a nonlinear saturation break point when the dysequilibrium of too much debt, too many overproduced and over valued assets, and declining total wages from decreasing demand – cannot service the global debt load.

The countervailing asset saturation curve is long term US debt….