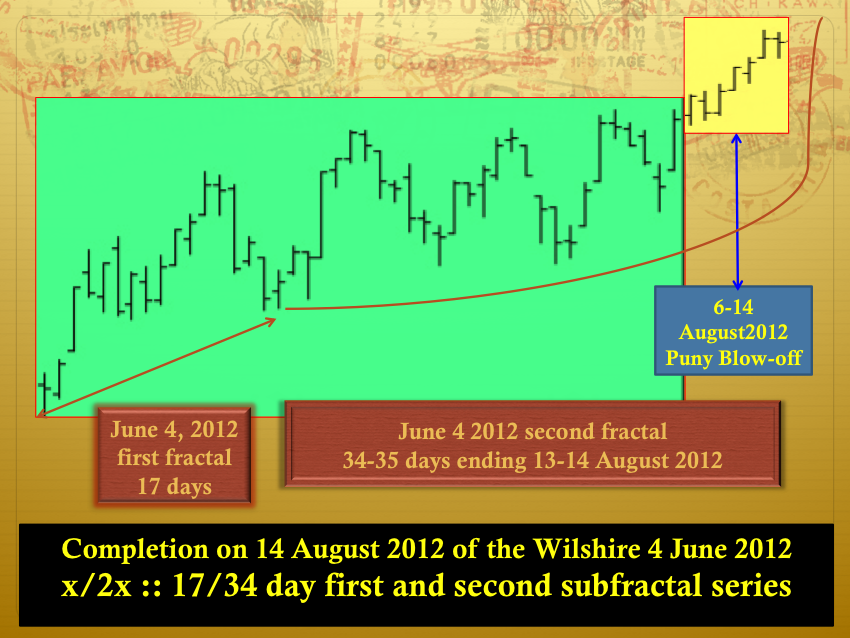

The Wilshire is the US 10 Year Note 30 Year Bond countervailing asset class in the asset-debt macroeconomic system. Both asset classes have ideal fractal terminal patterns on 13-14 August 2012.

Could there be a third fractal in the Wilshire? The fractal pattern of the US bonds are dominant. It appears that the Wilshire’s 1982 9/23 year x/2.5x pattern and larger 71/155 x/2x year pattern will end in a 17/34-35 day x/2x mini blow-off pattern before asset debt system synchronous nonlinear decay.