360% total 2022 US total debt to 2022 US GDP is one thing with US fed fund rates at near zero percent; but something quite different at a 10-11 month rapidly ratcheted 4.25 to 4.5% US fed funds rate.

The reactive large quantum raises by US and western central banks to control consumer inflation have acted akin to repetitively placing sequentially heavier 300, 600, 900, 1200 et. al. pound bags of straw on an aged overly-debt burdened osteoporotic Camel’s back.

The global asset debt macroeconomy and its assets’ valuations and the massive US 0.6 quadrillion dollar derivative positions involving those assets (and subject to margin calls) represent the integrated ingredients a nonlinear system. Expect a sudden and dramatic nonlinear decline in asset valuations.

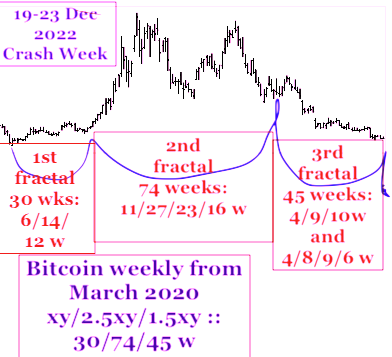

Is the system patterned and can the nonlinearity of asset valuations be predicted?

https://www.youtube.com/watch?v=lmHQ9v2ijsQhttps://www.youtube.com/watch?v=lmHQ9v2ijsQ