The world is at a precipice.

The exact value of self assembly quantum fractal asset-debt macroeconomics is this: its ability to determine the macroeconomy’s speculative asset saturation precipice with great accuracy: determining the timing of the complete exhaustion of the small speculator population in the secondary dominant speculative economy and the subsequent crash devaluation of both the speculative asset markets and of the real citizen economy.

It has done this with the elegant gold market. The crash came on the 55 month of a 27/67/54 month Lammert growth fractal with complete depletion of the small speculator population’s ability to buy further into the market.

Speculative crashes deplete wealth from the citizen base who use that wealth for collateral credit and exchangeable direct money equivalents to be used in the real economy. This citizen wealth is sequestered by the financial industry few who have little desire to purchase the quantities of real economy assets that wealth distributed among the citizen mass has and will purchase. This is exactly the cause of deflation and depression in the real economy as a causal aftermath of a speculative asset bubble collapse with widespread small speculator losses.

With the speculative asset bubble collapse the real citizen economy is burdened yet more with existing citizen debt which become relatively heavier and with citizen-liable over-valued assets -which like gold – contract further in value as demand in the real economy contracts and, with that demand contraction, occurs falling correlative wages.

Since the 1982,the financial industry speculative economy has become the dominant force in the asset debt macroeconomy, knocking off Glass-Steagall and allowing 30:1 leverage during its politically-infiltrating, rapidly-metastatic evolution.

Since 2009 the speculative financial industry economy has attracted more and more money from the those citizens with a job and with some savings which because of the lessening demand in the real citizen economy produced negligible interest returns.

In January 2013, US savers gave up in mass and joined the small speculators dumping 77 billion dollars of their savings into equities. The previous US record at 24 billion was in February 2000 – before the March 2000 equity peak valuation.

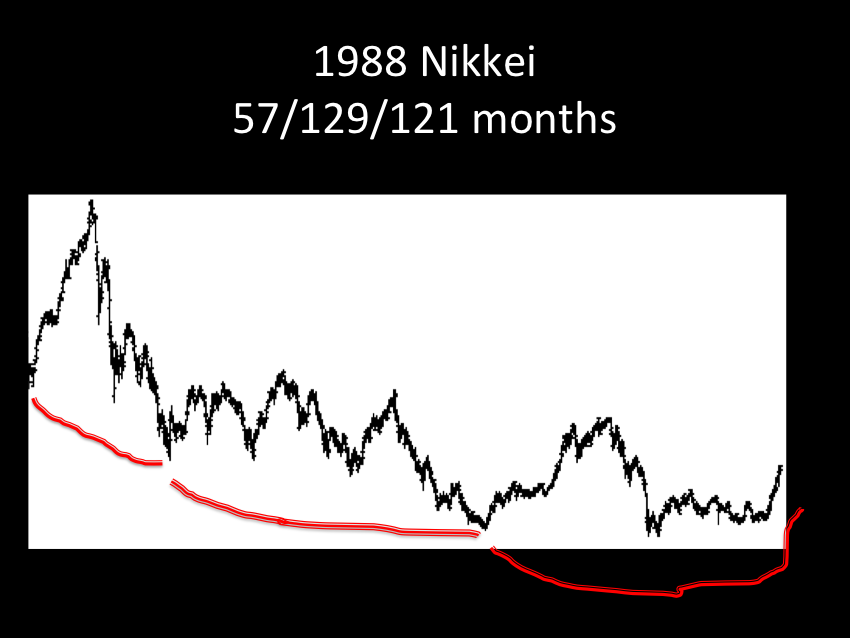

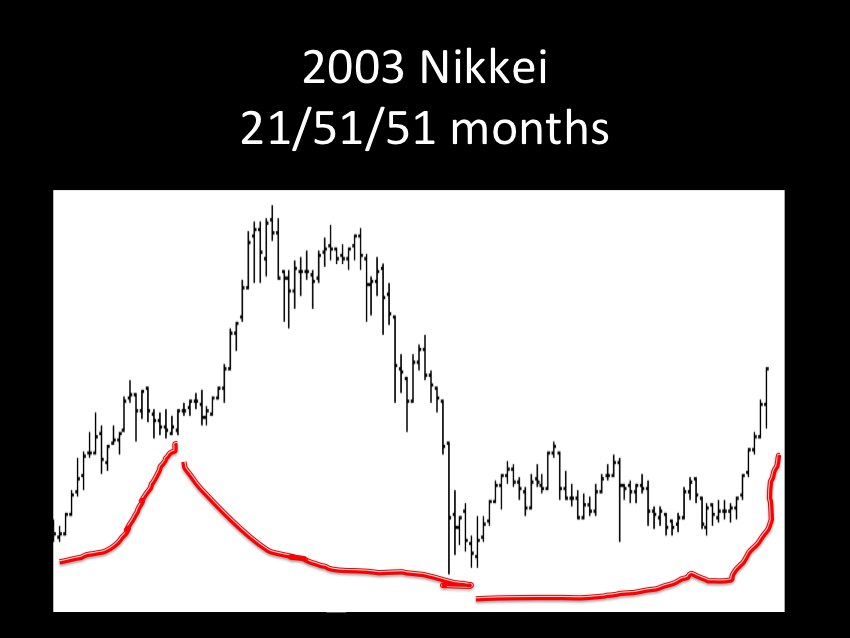

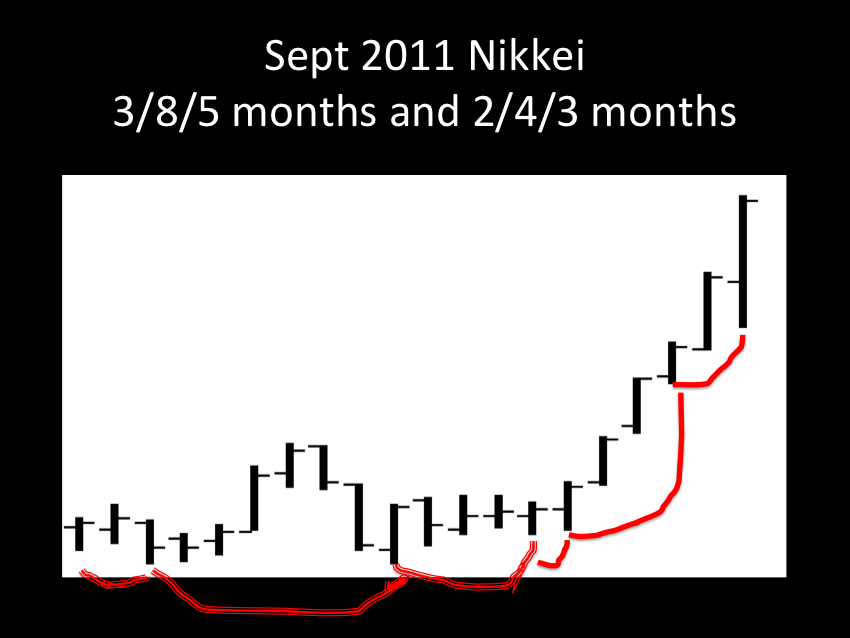

24 April 2013 Japan’s highly debt leveraged Nikkei:

1988 57/129/122 months; 2003 21/51-52/51-52 months; 2009 9-10/23/20 months; Sept 2011 3/8/5 and 2/4/3 months and …

11 October 2012 24/61/48 days and 13 November 2012 20/50/40 days … both ending with small speculation population exhaustion and depletion on 24 April 2013.