Who are the gaining counterparties? Who runs the global Asset Debt Macroeconomic system of which 80% of all transactions are in dollars?

Meet Irving’s much smarter namesake 2013 Hedge Fund Central Banker counterpart.

Will there be another financial collapse in Mr. Fischer’s life time?

The new feudal lords of the 21st century are the Central bankers, Hedge fund managers, the financial debt-leveraged buy-Out groups, the financial Debt industry, and the Ever gaining financial asset and money-changer manipulation bubble creating industry, ie, Wall Strret and London,and a few Families who transgenerationally have linkage and major ownership of a majority of all the preceding. The collective CHODEF collective owns the politicians who make the rules and have usurped all political decision making power. CHODEF’s use the protective ruse that they are merely abiding with, constrained by, and doing due diligence to the the laws and mandates created by the politicians … who they have owned since 1913 … and the eternal circle is completed….

The result is two economies: a defacto debt slave economy of the working class and a growing vortex, wealth-concentrating, debt-usury recipient, money-system and asset-debt bubble manipulation economy of a very small group of highly, highly intelligent, highly manipulative counterparties. There brains work on a different level than the lowly working citizens; they are 10 moves ahead of the serfs and sharecroppers toiling in the fields; they are the masters of the asset-debt macroeconomic system universe.

http://www.youtube.com/watch?v=Jxq7hiHi1cE

In the end, all citizens sharecrop for them. The vestiges of an Adam Smith capitalistic system involving real goods and services are buried in the matrix of the CHODEF’s very intelligently designed, self-advantaged, rule-controlled, and rule-protected virtual-money- exchanging, leveraged-vituals counterpartying, derivatives-asset-trading, and debt-leveraging buy-outs’ primary financial economic system.

From the 30 March 2013 posting:

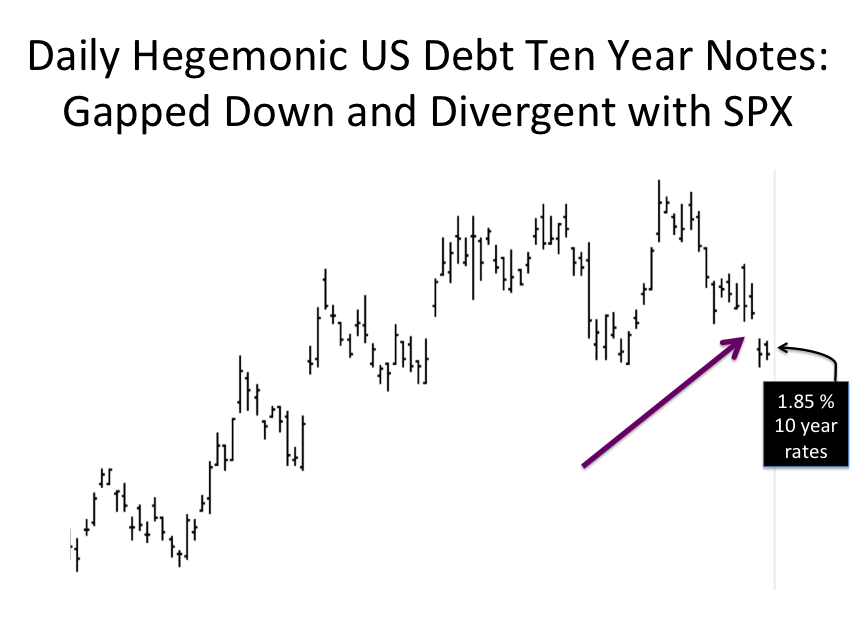

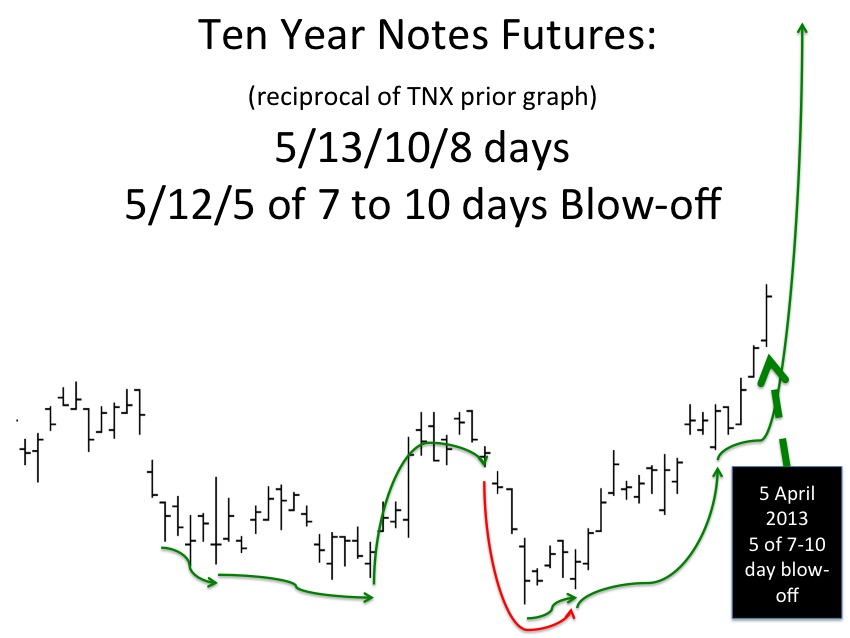

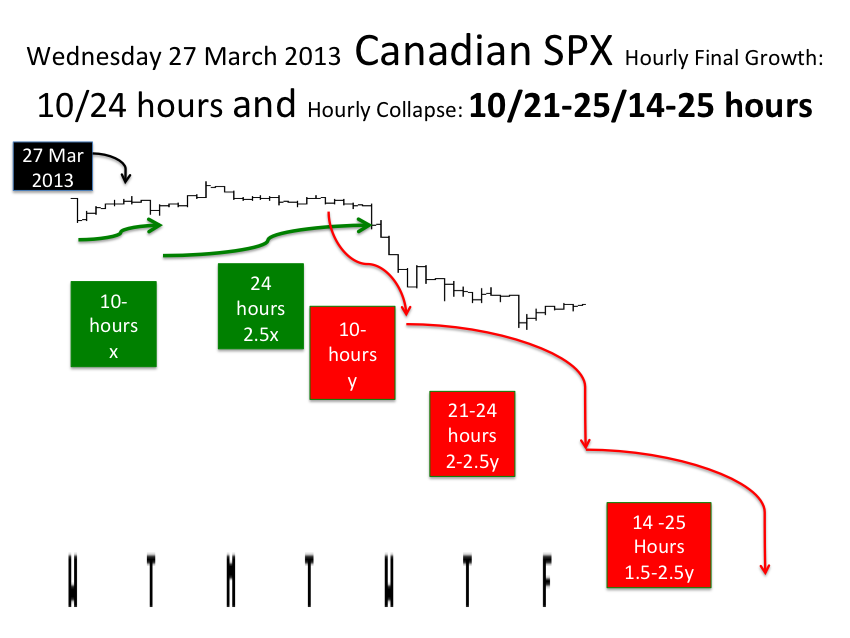

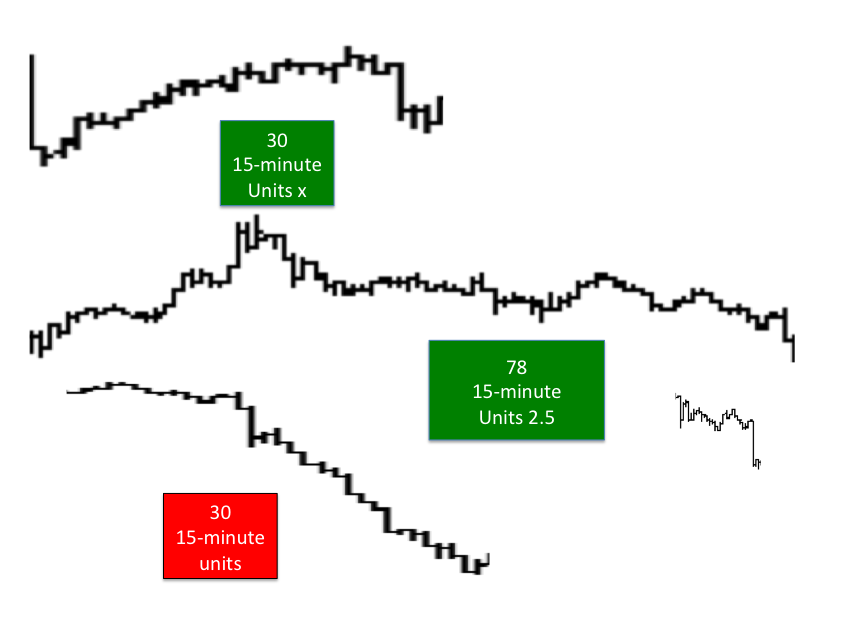

Question: Is this a TNX/TYX reciprocal 5-/10/3 of 8-10 day of 10 blow-off or a 5/11 to12 of 12 to13/7-10 day blow-off?

Answer: …. : a 5/11 to12 of 12 to13/7-10 day blow-off.

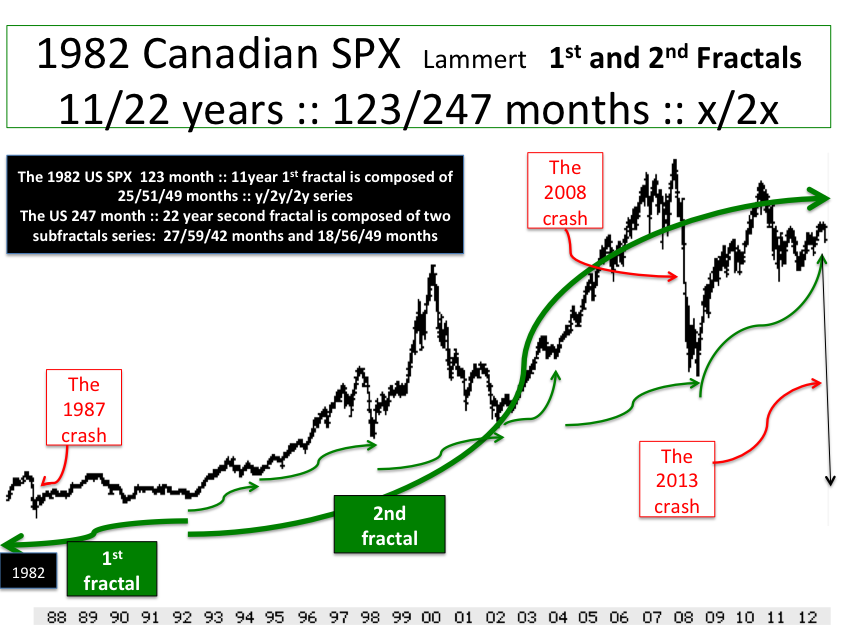

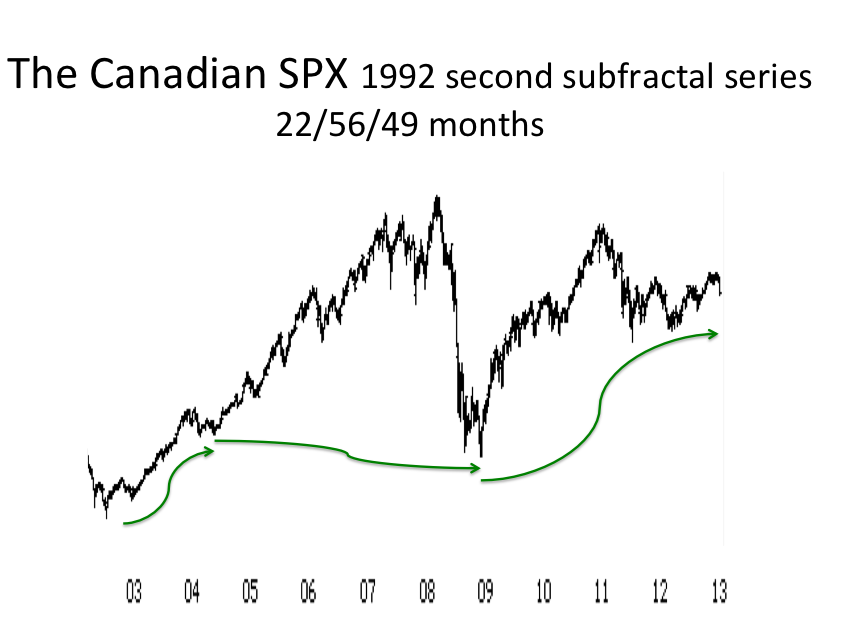

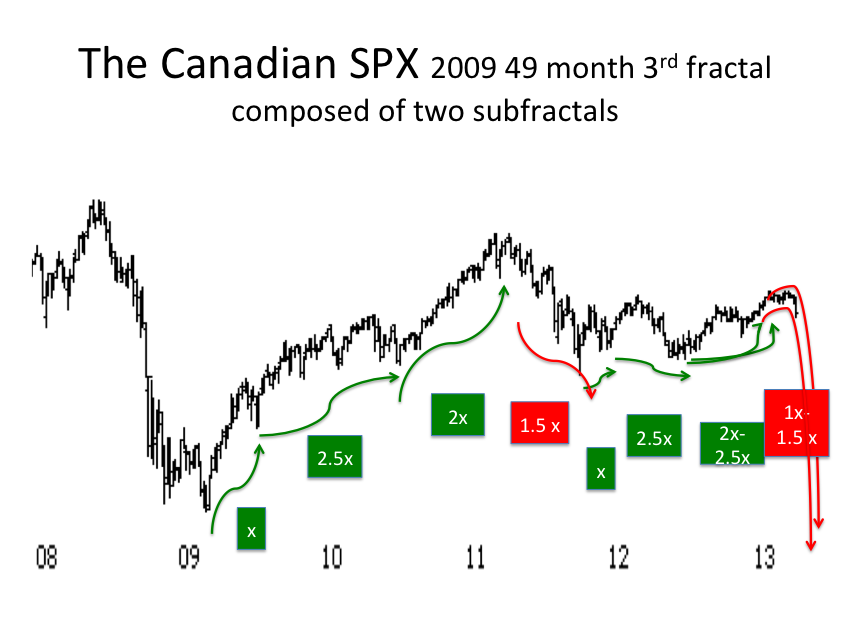

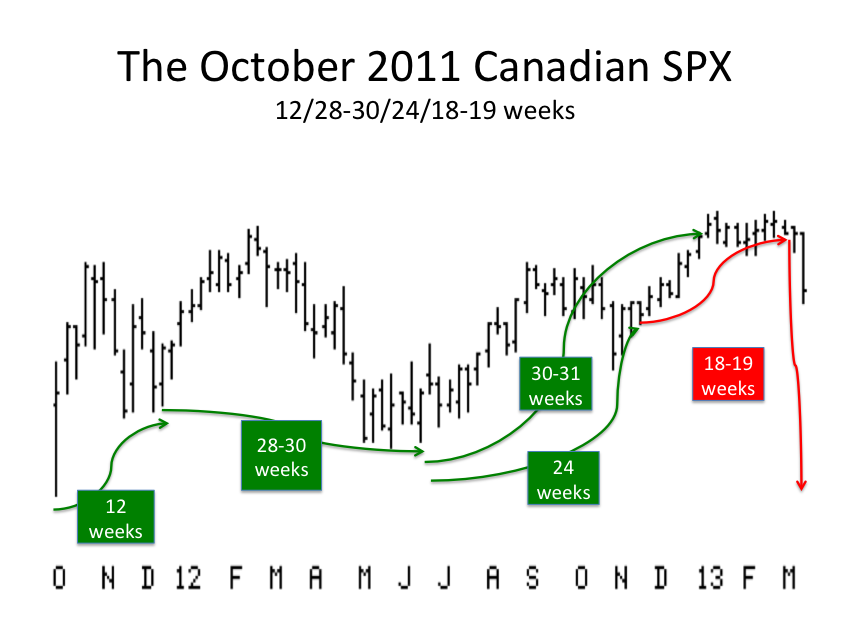

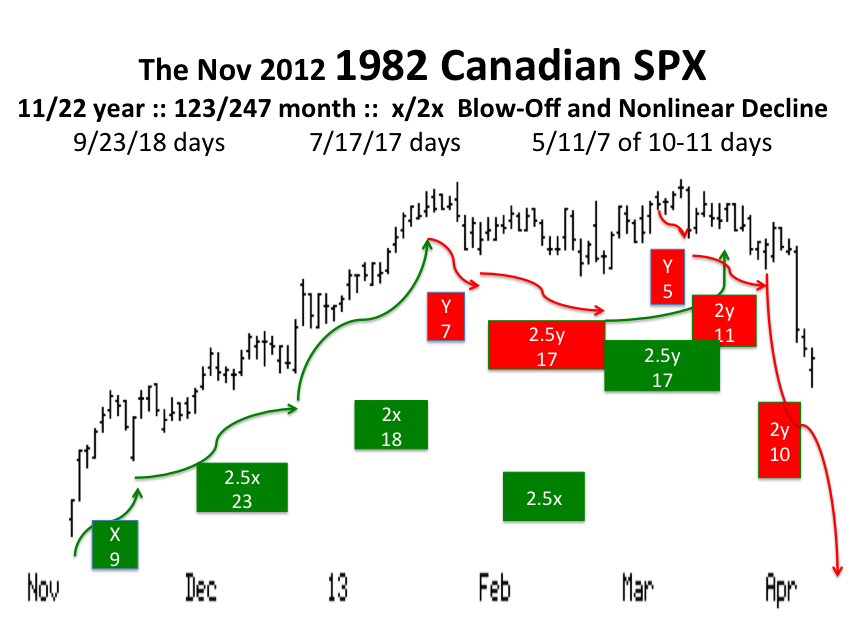

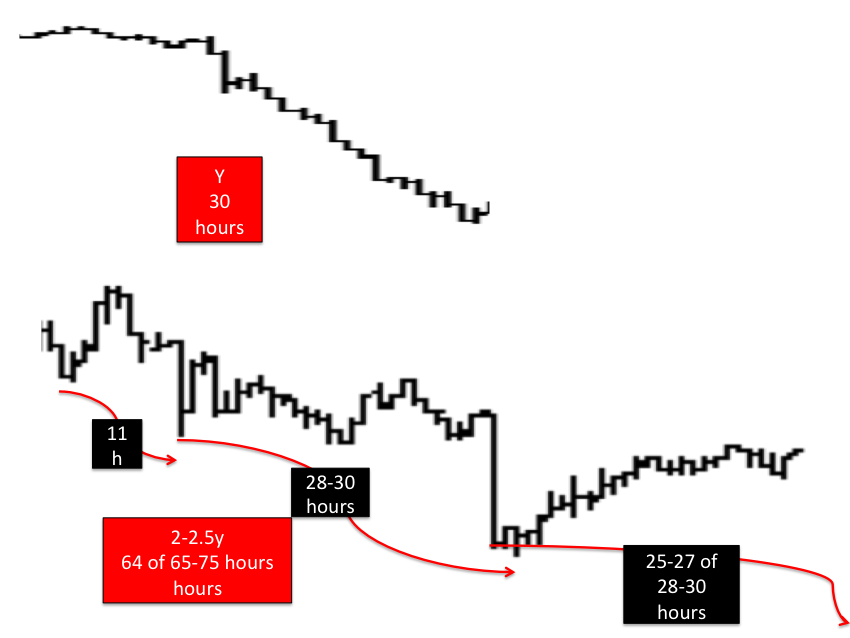

The Lammert Quantum Fractal Anatomy of the 1982 Canadian SPX Quantum x/2.5x :: 123/247 Month Historical Nonlinear Crash

This is part of a 1932 15/37/32 year :: x/2.5x/2x+ Maximum Growth Fractal Series. The 1932 US Equities second subfractal series is the conclusion of a 1789/1858 :: 70/156 year :: x/2x+ First and Second Fractal Series. In 2013 demand at the citizen base of the system for further first derivative debt expansion has asymptoted and demand-based total number of jobs at the economic citizen base has reached an asymptote. Misguided austerity programs and making the temporary tax cuts for the rich permanent has leveraged against the government’s ability to provide job stimulus programs.

At 190 trillion dollars, global debt has reached an Asset-Debt Macroeconomic System asymptote – some of the bad debt based on overvalued collateral assets must undergo default. Overvalued non US hegemonic debt assets will undergo valuation collapse as US sovereign hegemonic debt, of which 80 percent of global transactions are denominated in, and which will be absolutely repaid, will undergo valuation blow-off growth with ten year US note interest rates at less than 1.0 percent.

The Lammert Quantum Fractal Anatomy of the 1982 Canadian SPX Quantum x/2.5x :: 123/247 Month Historical Nonlinear Crash