And the Wall Street Economy disconnected from the real economy … and the small speculators with their life savings and now 401K’s … devastated …

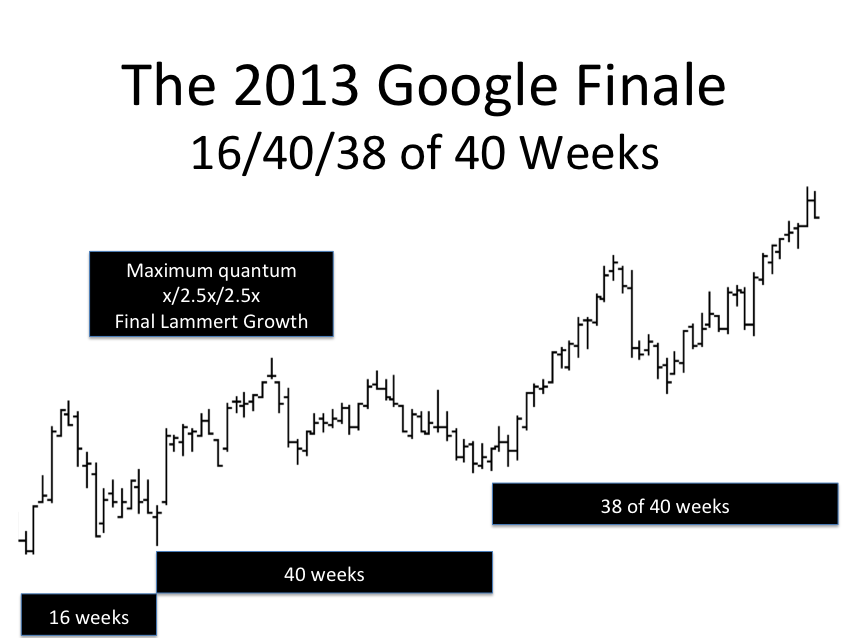

GOOGLE is currently 16/40/38 of 40 weeks. It has two more weeks to reach its final x/2.5x/2.5x maximum saturated growth.

The self-assembly Asset-Debt Macroeconomic System is evolving to a natural quantum transition point. Iconic GOOGLE represents the macroeconomic system’s most powerful transformational asset: the global sharing of information. There is a large population pool of interested investors in GOOGLE ‘derivative’ stock asset.

Google’s asset valuation evolution curve represents a significant microcosm of the entire asset-debt system.

What happens in the asset-debt system when the rules are so adjusted that it becomes more profitable to trade asset derivatives than to provide real services and innovate new useful products?

System activity migrates to money changing and leverage activities. Asset bubbles become the dependent variable of the independent variables of money changing and financial industry leverage.

Asset-debt ‘Utility’ is then caricatured, turned upside down, and becomes defined as the ability to quickly generate electronic money stocks. CEO’s of useful job creating industries, seeing the returns in the financial industry, turn their attention away from real production. In their board they aspire to emulate the financial industry’s gaming of the system.

The CEOs’ goals are transformed to generate money wealth rather than societally useful wealth denominated in real products and jobs to support them.

Legislation by paid-for politicians under reelection every two years create a steady rain of rules to protect those gaming the system and encourage further gaming.

Ultimately bad system rules lead to bad results.

What are those reasonable and good rules that support a solid citizen based asset-debt system, denominate currency exclusively in valued added labor, socially useful innovations and services, and promote a cohesive stable and balanced system?