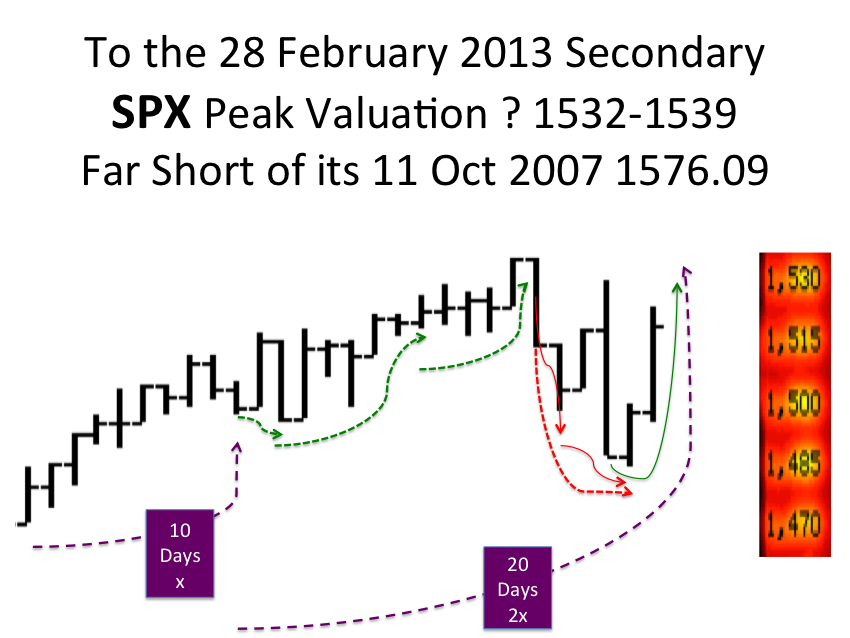

Look for a new multiyear minutely gapped high on 28 February 2013 for the SPX ending on or near the low of the day.

Why with so much bad news, really really bad dysfunctional US congressional news.. is the SPX making a new high on 28 February 2013?

The answer is: it, the US equity market, must do what deterministically, given the tax advantaged US equity profit laws and in the context and under the umbrella of a one quadrillion Asset-Debt global saturated macroeconomic system – now at its peak US composite equity time, … what it must do on 28 February 2013.

In simple words, the political maneuvering, the contrived sequestration, the outcome of the sequestration compromise, whether viewed positively or negatively for either the working party or the party of the transgenerationally legally entitled has nothing to do with independent operation of the too-big -to-affect One Quadrillion Asset-Debt System’s timed- based asset valuation curves.

(Parenthetically, remember the ease and speed of the bipartisan passage of the 750 billion dollar Wall Street bail-out which had an estimated value of over 12 trillion in relief. This real-economy-damaging, real-citizen-affecting 85 billion dollar sequester is chump change compared to the 140 times greater boost given to the financial industry with 144 billion dollars in CEO bonus’s given a year after the 12.8 trillion – not too much lobbying power or consideration for the little people…)

GM’s 6/16/12 of 12/1 of 9 week series (see last posting)suggest there are 8 more weeks until a major bottom.

8 weeks would represent about 38 days.

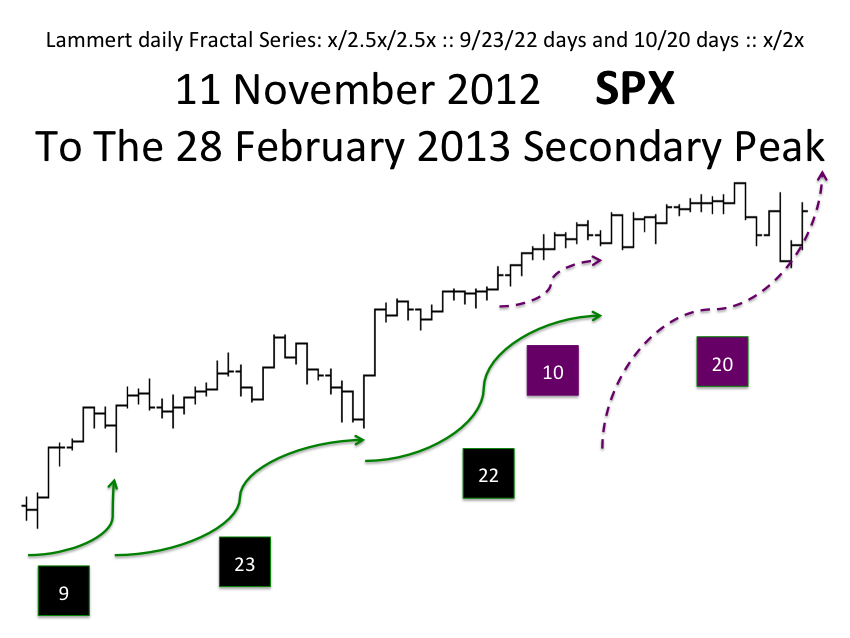

In this context a spx 10/25/20/15 day is possible with day 20 of the 25 day second fractal on 28 February 2013.