And so …..

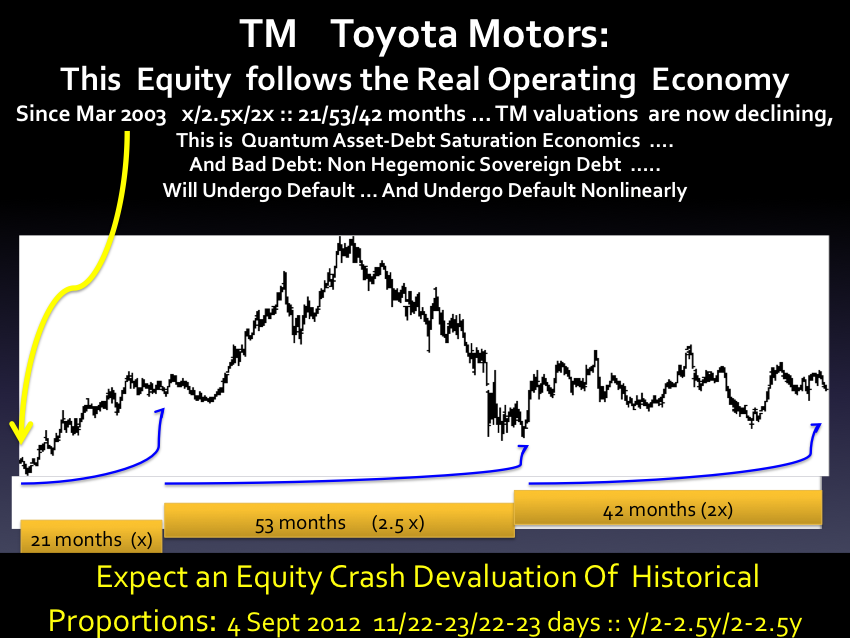

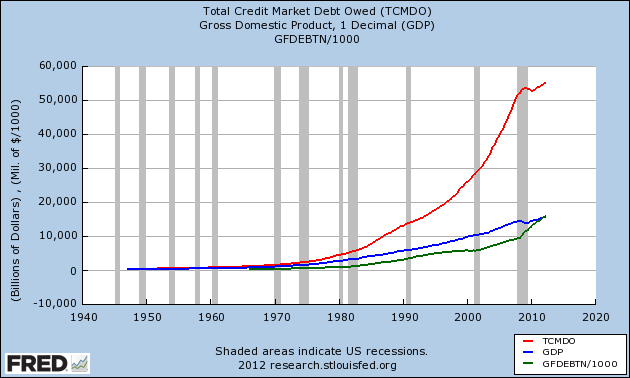

the 2003 quantitative TM x/2.5x/2x finale, the terminal portion of a 1987 40000 57/129/114 month Nikkei and the growing 55 Trillion dollar credit deficit of the US Economic Hegemonic System. The modest surge from 52 trillion in 2008 to 55-56 trillion in 2012 has been in federal debt which has kept the US System and the World System from imploding … Some might postulate that this credit-on-the-US- books expansion was done manipulatively by the US Central Bank …. but the reality is that Asset-Debt Global Macroeconomic System required and demanded this Keynesian action; it would have transpired regardless of the politically advantaged party.

This is the essential transitional element of the system……

Total US owed credit is 4 times US GDP. There has been a transitional crossover on the the charts. Ultimately real debt is repaid in real earnings, wages, and labor. The US saturated system of overproduced real estate and overvalued real estate created precisely by the financial debt debt industry and the financial debt industry’s owned bipartisan politicians – cannot support sufficient labor and associated wages – even at the necessary deterministic declining US sovereign interest rates – to support current asset valuations….

Collapse of asset valuations will necessarily occur.

It is Quantitative Asset-Debt Saturation Economics that integrates all of the parameters of this qualitative process of absolute inability to repay easy credit debt afforded and instrumented by the Financial Debt Industry ….and that deterministically evolves and generates the self organizing physic-equivalent time dependent quantitative asset valuation decay curves …. that confers on the Global Macroeconomic System …………… the precise characteristics of an exact patterned science.