From the 2005 Main Page of The Economic Fractalist:

” The ideal growth fractal time sequence is X, 2.5X, 2X and 1.5-1.6X. The first two cycles include a saturation transitional point and decay process in the terminal portion of the cycles. A sudden nonlinear drop in the last 0.5x time period of the 2.5X is the hallmark of a second cycle and characterizes this most recognizable cycle. After the nonlinear gap drop, the third cycle begins. This means that the second cycle can last anywhere in length from 2x to 2.5x. The third cycle 2X is primarily a growth cycle with a lower saturation point and decay process followed by a higher saturation point. The last 1.5-1.6X cycle is primarily a decay cycle interrupted with a mid area growth period. Near ideal fractal cycles can be seen in the trading valuations of many commodities and individual stocks. Most of the cycles are caricatures of the ideal and conform to Gompertz mathematical type saturation and decay curves.

G. Lammert

This page was last updated on 15-May-2005 01:21:59 PM .”

Why August 2012 as the Final Lower Global Equity High?

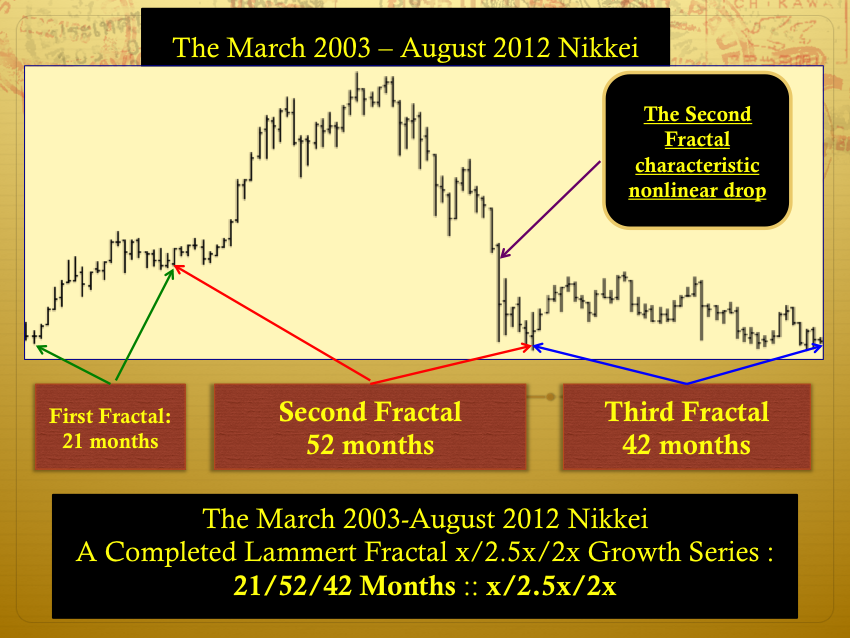

August 2012 completes a 21/52/42 month :: x/2.5x/2x ideal Nikkei three phase fractal growth series which began on 11 March 2003. August 2012 is the 42nd month of the 42 month third growth fractal of the 21/52/42 series.

The expected fourth fractal of this series would ideally be 1.5-1.6x or 32-34 months which coincides with the 1929-1932 and 2000-2003 peak to nadir equity valuations.

113 months compose the March 2003 to August 2012 Nikkei 21/52/42 month final Lammert growth fractal series.

This 113 months composes the third fractal of a much larger Nikkei fractal series: a 57/129/113 :: x/2-2.5x/2x Nikkei declining fractal growth series beginning in late 1987.

Inflation adjusted for late 1987 the Nikkei has lost well over 90 percent of its peak valuation.

Most substantially this is the terminal time area of the US asset-debt system’s second fractal beginning in 1858. A 155 year second fractal nonlinear asset devaluation transformation of historical proportions will occur and is well timed with the European Euro debt-asset system debt default and disintegration and the correlative US state, county, and city municipalities debt default and disruptive restructuring.