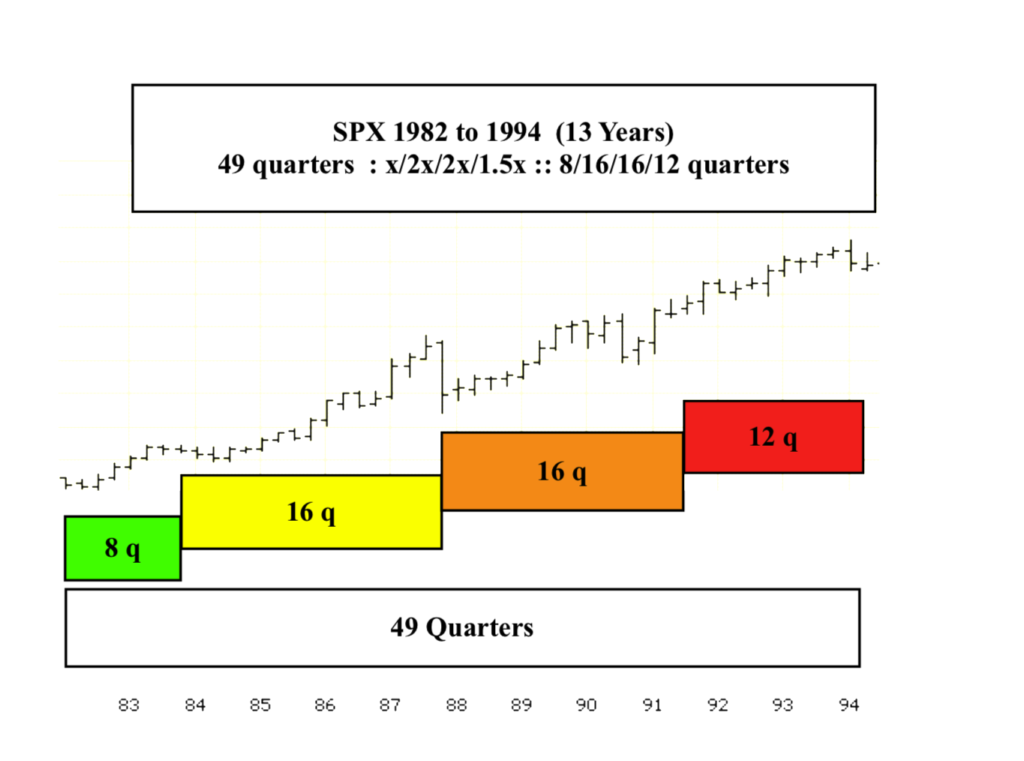

March 2020 Peak Lammert Fractal Growth and the Great 1982 13/31-32 Year Crash

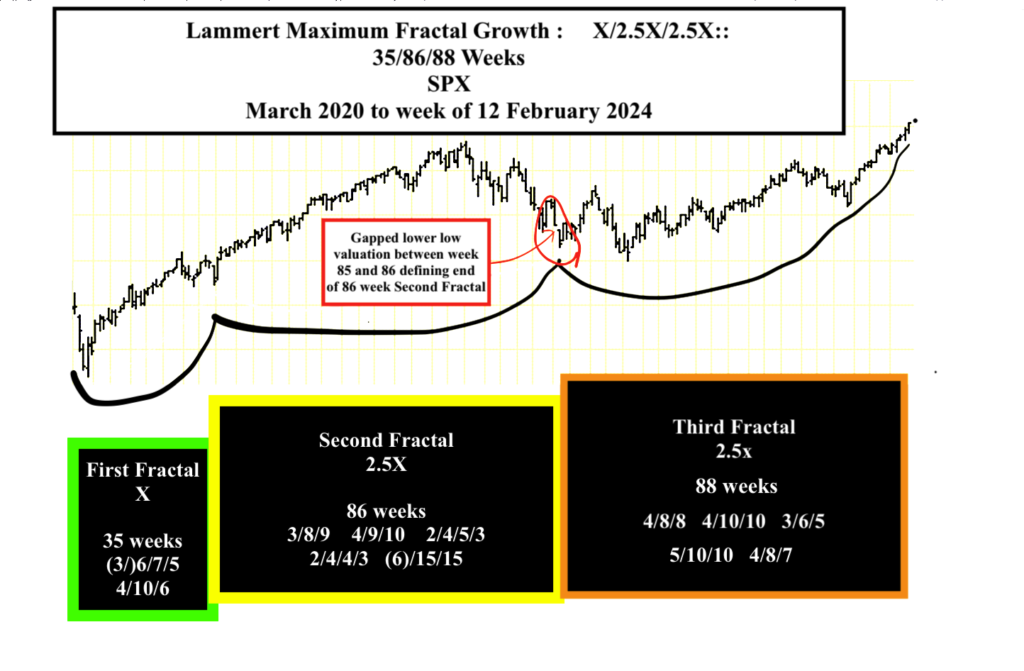

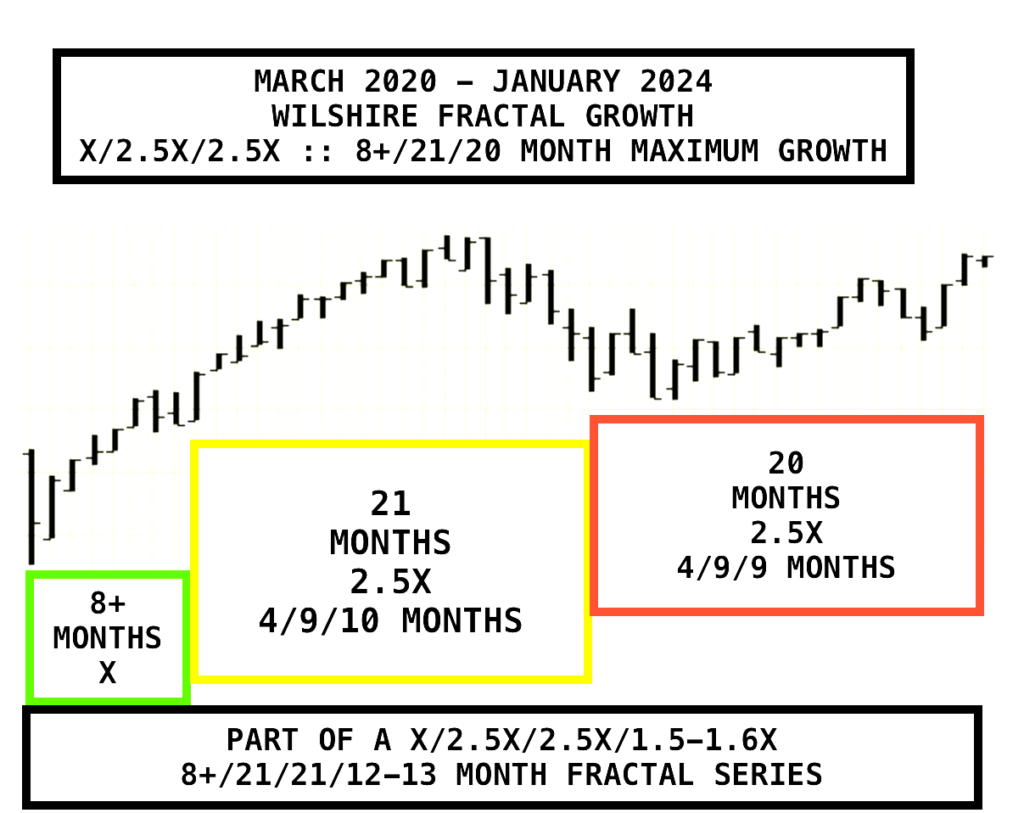

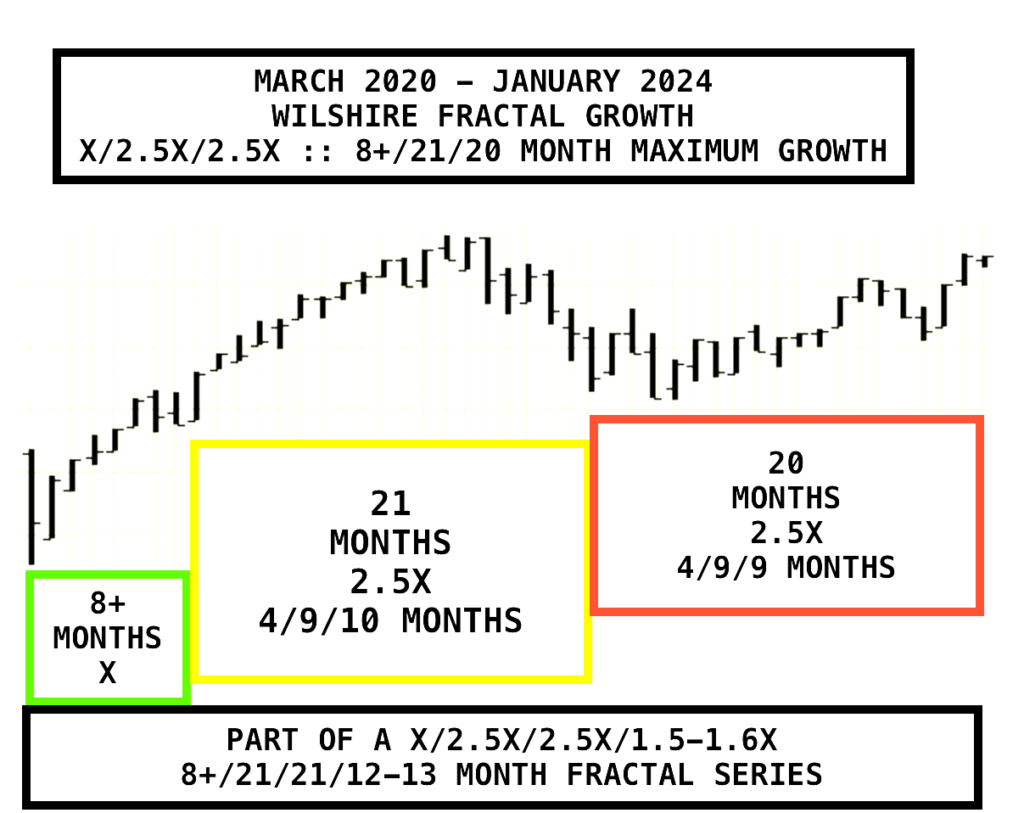

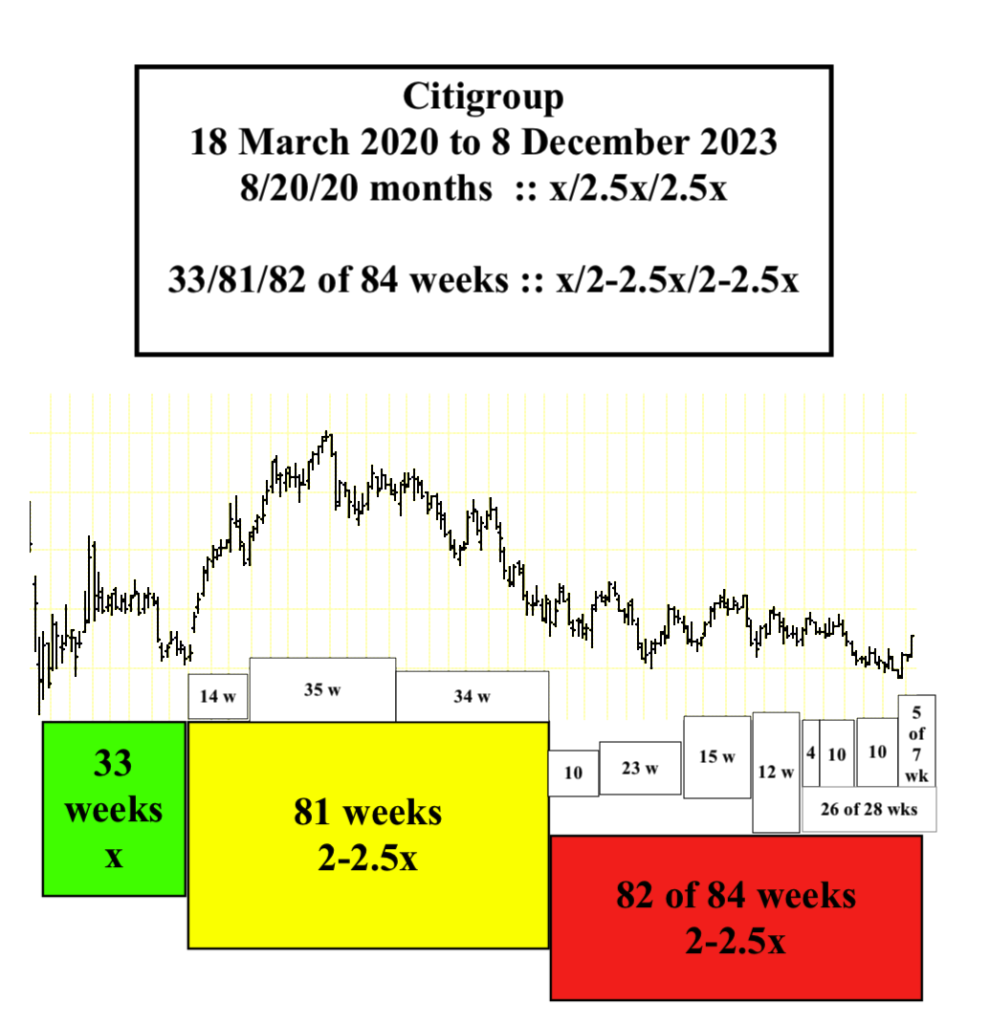

From March 2020 the fractal math for the maximum time based self-assembly fractal growth for equities is quite simple : X/2.5X/2.5X , where X is the time length of the First Fractal Base ending in a low valuation (30 October 2020), 2.5X is the time length of the Second Fractal ending in a low valuation (16/17 June 2022), and 2.5X is the time length of the Third Fractal ending in a peak valuation. (12/13 February 2024)

First Fractal: X: 35 weeks: 23 March 2020 to 30 October 2020

(3)/33 weeks {the first 3 weeks (3) represent preceding terminal decay}

X is the time length of the First Fractal with all intervening daily/weekly valuations above the valuations of the first and last time unit (day or week) of the First Fractal Base grouping. Because growth begins in decay, the First Fractal Base X includes 3 weeks of a preceding decay series. This 3 week grouping serves as base subfractal for (3)/6/7/5 week subfractal growth series within the First Fractal Base. (see above figure)

Second Fractal: 2.5X: 86 weeks 30 October 2020 to 16/17 June 2022

The Second Fractal is the most characteristic Fractal unit and is defined by an observable nonlinear gap lower low valuation between 2X and 2.5X. See the 2005 opening page of The Economic Fractalist website. This occurs between week 85 and 86. (see above figure)

Third Fractal: 2.5X: 88 Weeks 16/17 June 2022 to 12/13 February 2024

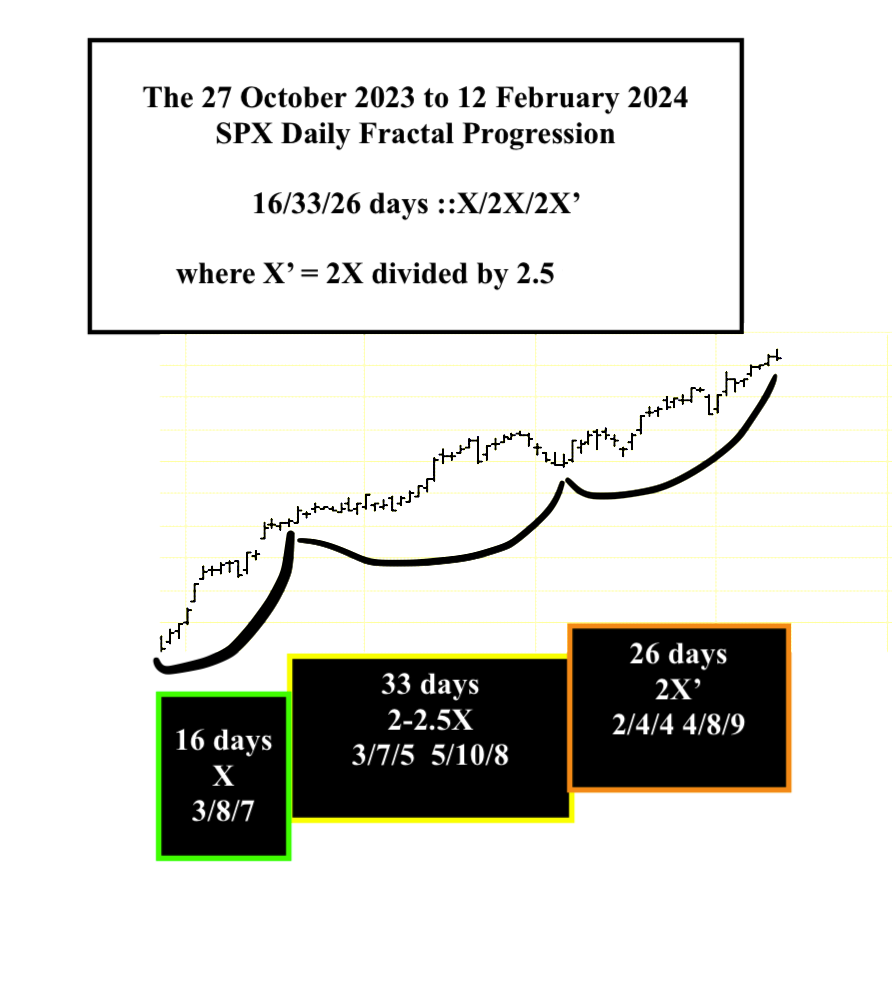

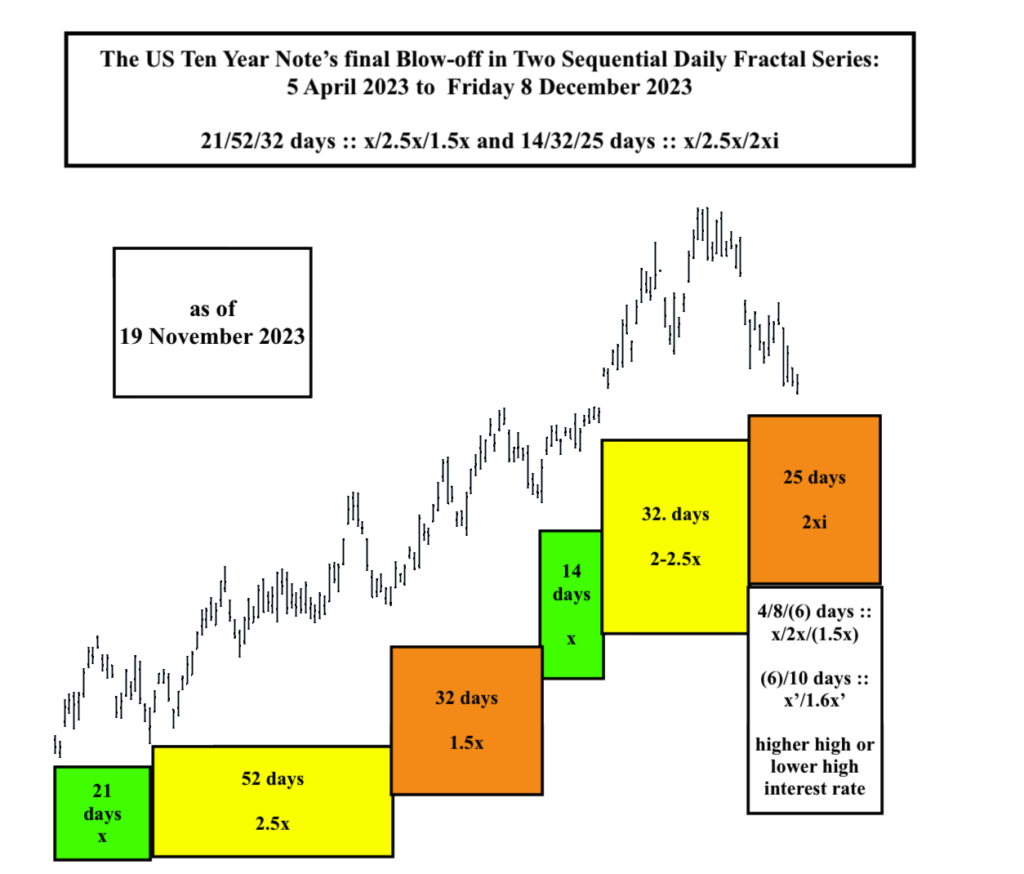

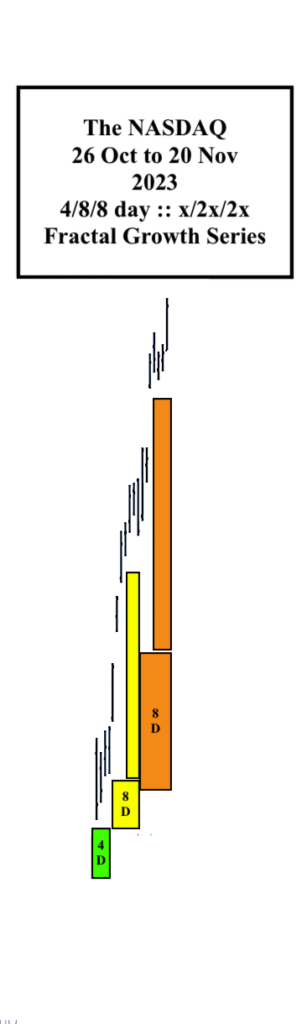

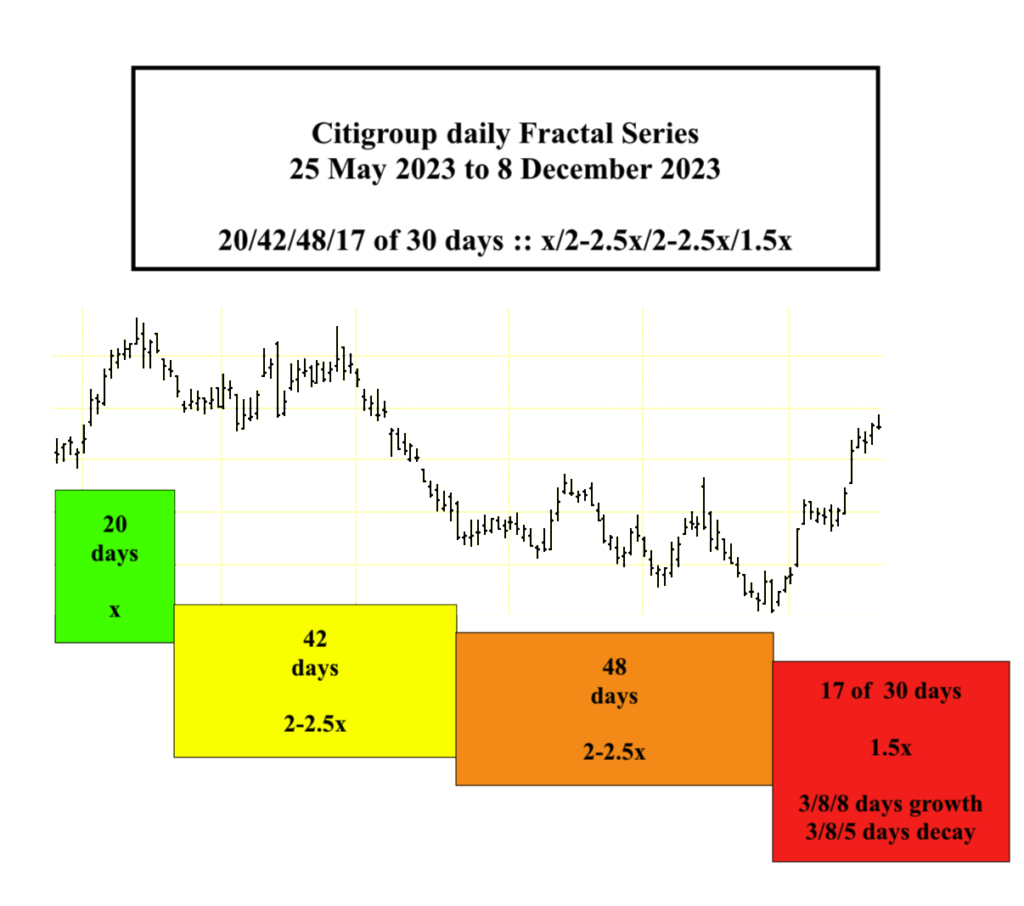

The Third 88 week 2.5X Fractal was completed on 12/13 February 2024 and was concluded with a daily Lammert fractal growth series starting 27 October 2023. (below image)

The concluding 27 October 2023 self assembly growth fractal series is composed of a 16/33/26 day fractal series. In this case the Second Fractal of 33 days days determines the ideal length of the first base fractal as 13 days (33 divided by 2.5) The Third Fractal of 2X or 2 times 13 is 26 days occurring on 12 February 2024. The SPX made a new high on 12 February 2024 and ended near the low of the trading day.

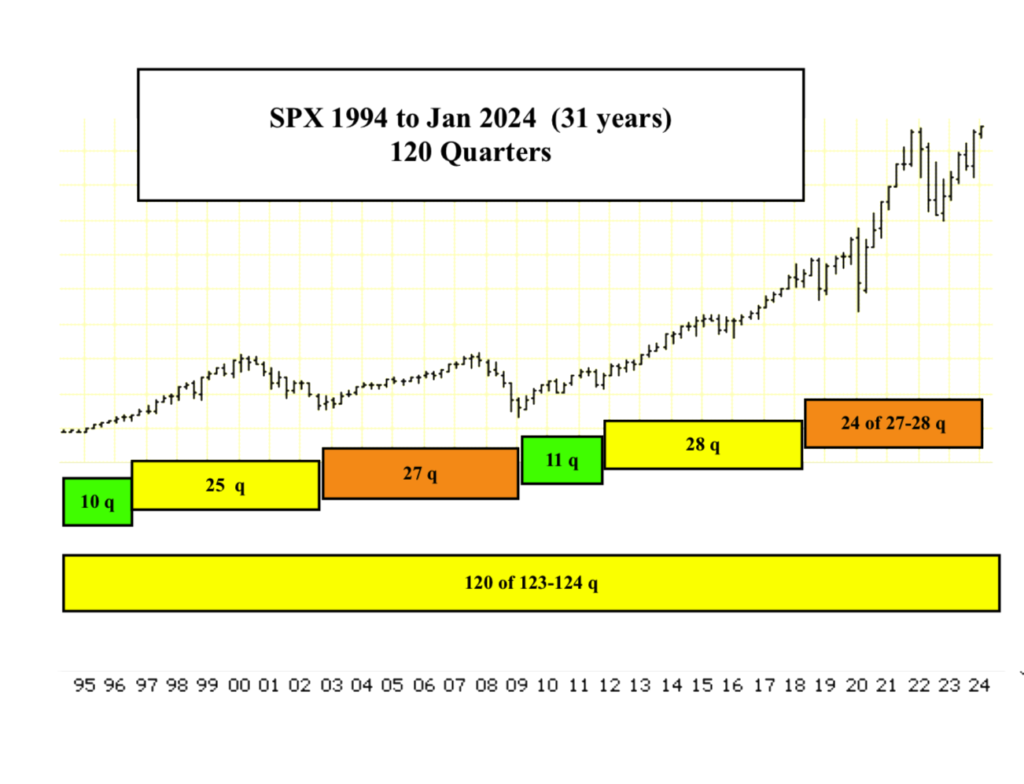

A hard landing is coming for the global economy with an expected global equity low valuation in January/February 2025.