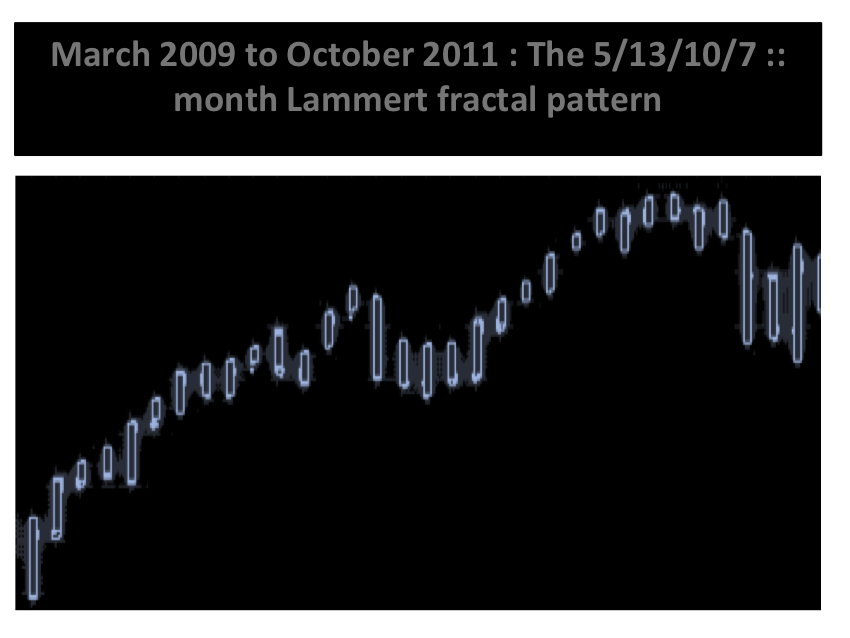

The 2005 Predicted Lammert Growth and Decay Pattern: the Wilshire of the debt-asset system empirically self assembles itself into a 2009-2011 monthly Lammert 4 phase fractal series.

(What daily economic news produced this pattern? Answer: None. … just as the daily economic news has no impact on the evolution of the current Wilshire’s daily valuations … the valuation pattern self assembles within the context of the one quadrillion valued global debt-asset system.)

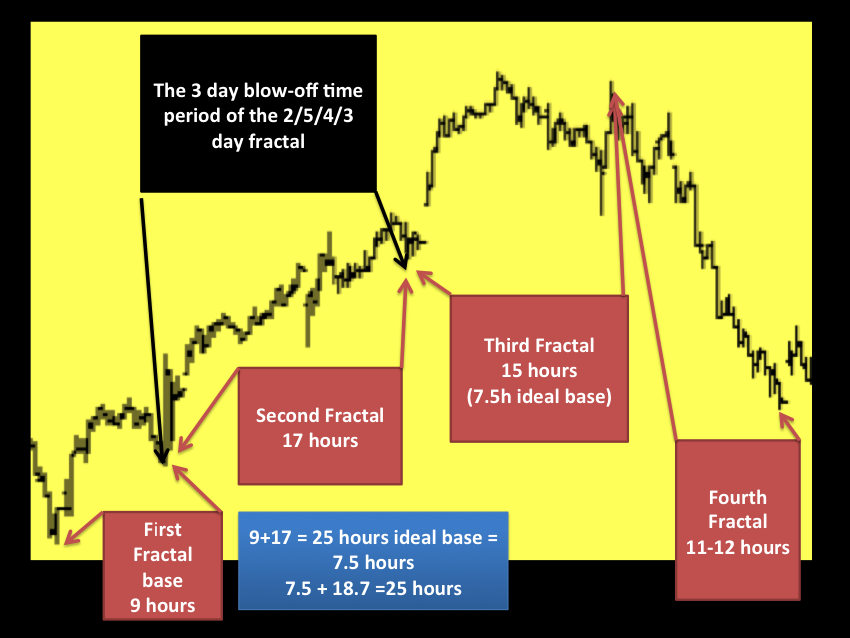

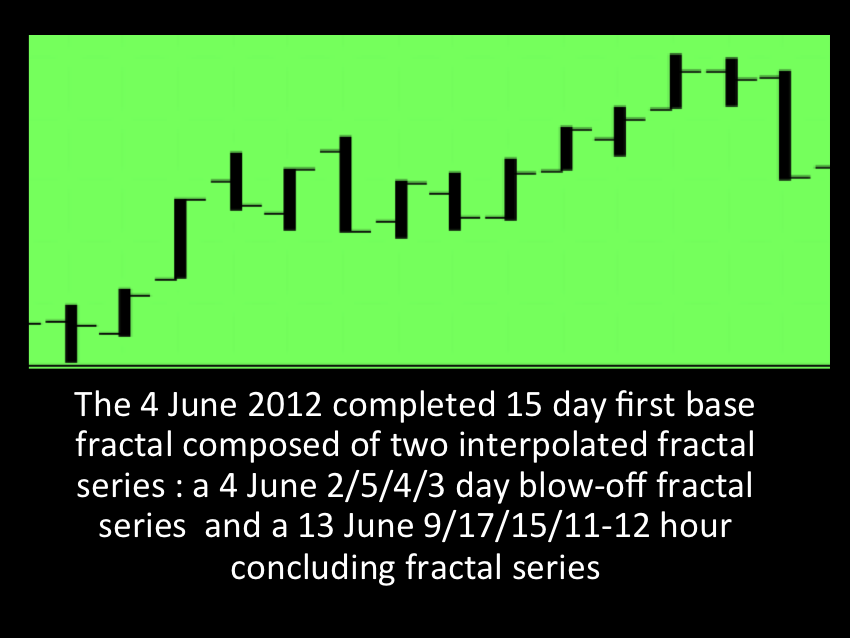

From the recent unfolding self organizing and empirical data provided by the Wilshire’s daily valuation charts and the Wilshire’s more important countervailing monthly and weekly fractal patterns of the intermediate and long term US debt market, the Wilshire’s final 4 June 2012 third fractal will be composed of two three phase subfractal series.

The first subfractal three phase series is a 4 June 2012 6/14/4 of 9 to 10 day Wilshire pattern. Day 9 or day 10 of the 6/14/9-10 day fractal should return the Wilshire to a valuation level of 13700-13900.

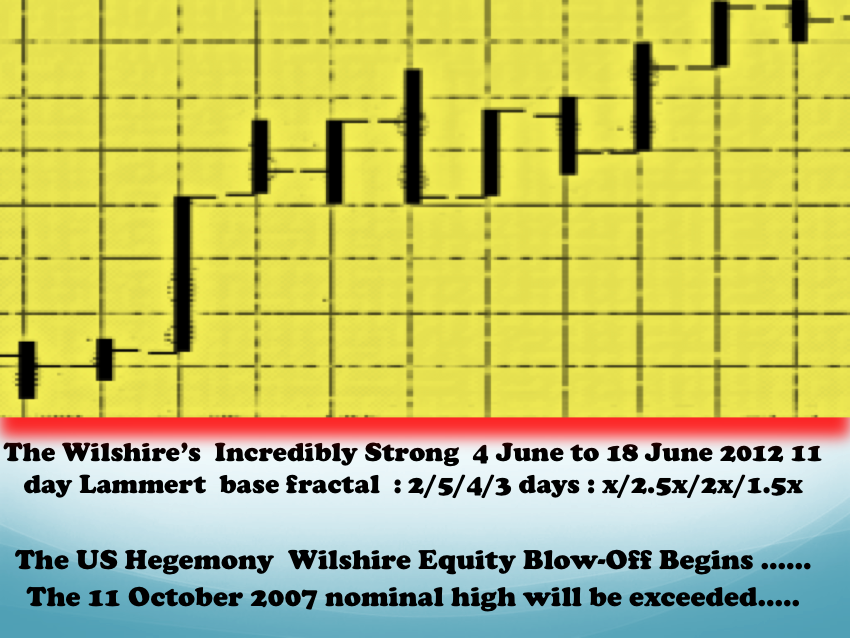

Thereafter, the second subfractal three phase series composing a Wilshire blow-off pattern of 6-7 weeks will occur. This will take the Wilshire to its final pre historical crash high valuation in August 2012.

The global debt asset macroeconomic system has been evolving mathematically to its inevitable deterministic 150 year second fractal historical transition time area. August 2012 is the inflection time area for the transition described in the Main Page of TEF ….. “This site has been constructed because of the expected inevitability of a major sudden phase transition to occur ……

A sudden second fractal nonlinear reordering of the debt-asset macroeconomic system will mathematically occur. While the timing will coincide with European system failure, the nonlinear collapse of US non sovereign debt assets involves the larger global dysequilibrium of too much leveraged forward consumption and resulting unrepayable debt whose collateral are falling oversupplied real estate valuations and a contracting number of needed jobs and a contraction of total wages those jobs represent – wages that support the debt load.

A deflationary implosion of historical proportions is at hand. But first the two subfractal three phase series equity 4 June 2012 third fractal blow-off.