8 November 2021 represented the peak valuation for the US (then) 48.95 trillion dollar Wilshire equity index composite.While this date was not prospectively predicted by fractal analysis for the self-assembly asset-debt system,it represented a x/2x/2x :: 31/62-63/62-63 monthly growth from the March 2009 low and a 36/90/90 year :: x/2.5x/2.5x growth from the US hegemony low starting in 1807.

Interest rates for US sovereign long term Notes and Bonds have been declining in a cascading manner since the Volcker peak of September 1981 with a series of lower high interests preceded by lower lows.The last cycle starting at its low for the US Bond market began in December 2008 at 2.61% after the 3 October 2008 Emergency Stabilization Act and the preceding housing bubble induced Lehman Brother’s implosion. The US 30 year Bond’s cascadingly lower highs and lower low interest rates were propelled by post 2009 QE programs and post covid MBS’s and resulted in another lower low in April 2021 at 1.17%. With covid checks exceeding annual wages and resulting in 2 trillion dollars of savings and with low MBS mortgage rates of less than 3.5 % (and significantly less for the Blackstone-like financial industry mortgage acquirers), the new credit and money resulting inflation caused blow-off fractal growth of interest rates with a peak 30 Bond interest rate of 5.053% occurring on 6 October 2023.

Do Debt Market valuation follow Lammert quantum fractal patterns?

The following monthly, weekly, daily fractal series represent Bond interest rate growth rather than previously purchased bonds’ ongoing converse valuation decay. These two entities are the (near exact) inverse mirror valuations of each other. Bonds purchased in April 2021 at a 1.17% yield are, as of 6 October 2023, currently worth only about 22 – 24% of their purchase value.

Do US Bond interest rates undergo the Asset-Debt macroeconomic system’s quantum fractal self-assembly?

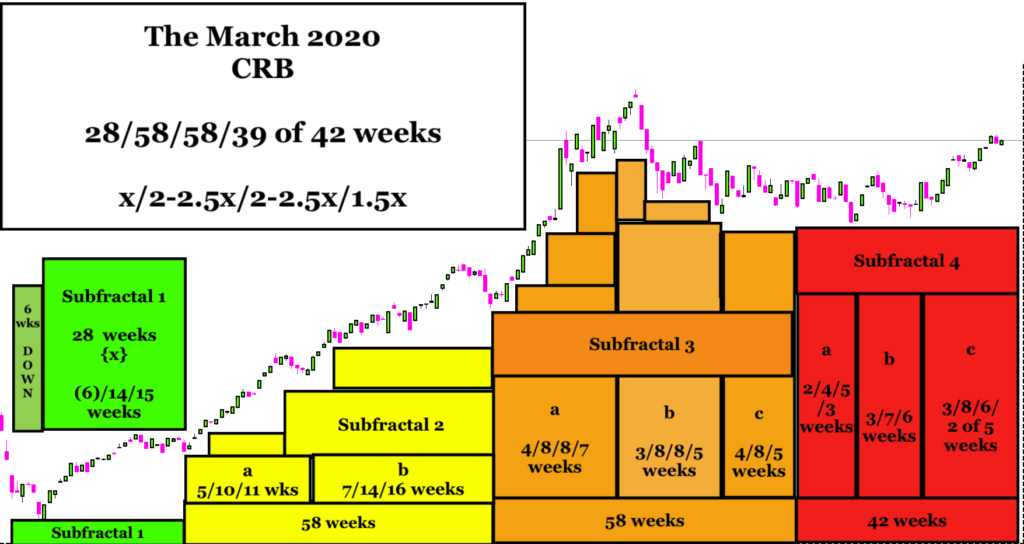

Since the March April 2020 low, 30 Year US Bond interest rate growth has occurred in two monthly fractal series: 7/16/16 months and 2/4/4 months reaching peak on 6 October 2023. The last 2/4/4 fractal series . represents a blow-off x/2x/2x growth fractal series.

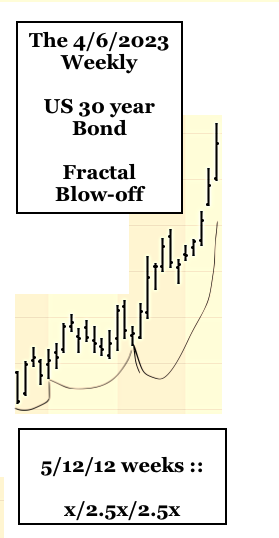

The final 2/4/4 month fractal series starting 6 April 2023 is a 5/12/12 week series ending 6 October 2023.

Three Blow-off higher high exhaustion gaps in the terminal 13 days

The final 12 weeks of the 5/12/12 week series starts on 19 July 2023 and is self assembled into three Lammert fractal series: a 4 phase series of 5/12/10/8 days :: x/2.5x/2x/1.6x; a three phase series of 3/7/6 days :: x/2-2.5x/2x with a higher high exhaustion gap between the second and third (three phase) fractal series of 3/6/6 days :: x/2x/2x with a higher high exhaustion gap between day 1 and day 2 of the 6 day subfractal two and a higher high exhaustion gap between day 2 and day 3 of the final 6 day subfractal 3.

The peak of bond Market interest rates likely represents the final lower high of equity valuations. Money exiting from equities will drive interest rates cascadingly lower and ultimately lower than the April 2021 1.17% low.

(Below: amended 8 October 2023)

The projected major self-assembly major quantum interim fractal low for global equities is 27 October 2023.

Based on the Bank of the Shanghai monthly, weekly and daily quantum fractal patterns, the projected major interim fractal low for global equities, commodities and cryptocurrencies is 27 October 2023.

For the Wilshire composed from its August 2023 low, the current working fractal model is (2) sequential 3-phase Lammert fractal decay series of 5/10/11 days ending 29 Sept 2023 followed by and starting on 29 Sept 2023, a 5/8 of 12 days /12 days ending 27 October 2023.

For the Nikkei from its 17 August 2023 low, the two sequential Lammert fractal decay series are 6/12/13 days followed by a fractal series of 4/4 of 10/10 days and ending on 27 October 2023.

Money exiting the collapsing US stock market will drive US Bond interest rates cascadingly to lower lows and eventually lower than the April 2021 1.17% low.

Next: China property wealth ownership and the implosion of the collective personal wealth of Chinese citizenry.